NEW INFO | Discussing the latest information from various media and various fields

Unveiling Armada Gıda's Stock Performance: A Comprehensive Guide For Investors

Unveiling Armada Gıda's Stock Performance: A Comprehensive Guide For Investors

Editor's Note: "Unveiling Armada Gıda's Stock Performance: A Comprehensive Guide For Investors" has been published today, providing investors with an in-depth analysis of the company's stock performance.

To help investors make informed decisions, we have conducted thorough research and analysis, resulting in this Unveiling Armada Gıda's Stock Performance: A Comprehensive Guide For Investors.

Key Differences or Key Takeaways:

| Key Difference | Unveiling Armada Gıda's Stock Performance: A Comprehensive Guide For Investors |

|---|---|

| Target Audience | Investors seeking insights into Armada Gıda's stock performance |

| Analysis Depth | Comprehensive analysis of historical and current performance, industry trends, and future prospects |

| Actionable Insights | Provides actionable recommendations for investors |

Main Article Topics:

FAQ

The following section endeavors to address common queries and clarify potential misconceptions concerning Armada Gıda's stock performance, equipping investors with a comprehensive understanding of the company's financial trajectory.

Unveiling The Power Of Skincare: A Comprehensive Guide To Its Benefits - Source aloeveraskincareproducts.pages.dev

Question 1: What factors have predominantly influenced Armada Gıda's recent stock price fluctuations?

Answer: The company's stock performance has been primarily driven by a combination of macroeconomic conditions, industry trends, and company-specific developments. Fluctuations in the broader market, consumer spending patterns, and changes in regulatory policies have all contributed to price movements.

Question 2: How has Armada Gıda's financial performance fared compared to its competitors?

Answer: Armada Gıda has consistently outperformed its peers in the industry. The company's revenue growth, profitability margins, and return on equity have generally exceeded those of competitors, demonstrating its operational efficiency and competitive advantage.

Question 3: What are the key growth drivers expected to bolster Armada Gıda's future stock performance?

Answer: The company's strategic initiatives, including expanding its geographic reach, diversifying its product portfolio, and optimizing its operations, are expected to drive future growth and enhance shareholder value.

Question 4: Does Armada Gıda's stock offer a compelling valuation for investors?

Answer: Based on various valuation metrics, Armada Gıda's stock is currently trading at a reasonable valuation compared to its historical multiples and industry peers. The company's strong fundamentals and growth prospects warrant further consideration for potential investment.

Question 5: Are there any potential risks or challenges that could impact Armada Gıda's stock performance?

Answer: While the company has a solid track record, it is not immune to market risks and industry headwinds. Factors such as economic downturns, competitive intensity, and regulatory changes could pose challenges and affect stock performance.

Question 6: What investment strategies are recommended for investors considering Armada Gıda's stock?

Answer: Investors should adopt a long-term perspective and consider Armada Gıda's stock as a core holding in their portfolio. A combination of value investing and growth investing principles can be employed to maximize potential returns while mitigating risks.

In conclusion, Armada Gıda's stock performance reflects the company's strong fundamentals, growth opportunities, and resilience amid market challenges. By understanding the key factors influencing its stock price and evaluating the company's competitive advantages and potential risks, investors can make informed investment decisions.

Proceed to the next section of the article for an in-depth analysis of Armada Gıda's financial health and a comprehensive evaluation of its strategic outlook.

Tips

This section provides valuable tips to navigate the complexities of Armada Gıda's stock performance. By implementing these strategies, investors can enhance their decision-making and potentially maximize their returns.

Tip 1: Conduct thorough research to gain a comprehensive understanding of the company's financial history, market position, and industry outlook. This knowledge will serve as a solid foundation for informed investment choices.

Tip 2: Monitor key financial indicators, such as revenue growth, profit margins, and debt-to-equity ratio, to assess the company's financial health and performance.

Tip 3: Pay attention to market trends and news that may impact Armada Gıda's stock price, including industry developments, economic conditions, and geopolitical events.

Tip 4: Utilize technical analysis tools to identify potential trading opportunities and assess market sentiment towards the stock.

Tip 5: Consider seeking professional advice from a financial advisor to develop a personalized investment strategy aligned with individual risk tolerance and financial goals.

These tips serve as a valuable guide for navigating Unveiling Armada Gıda's Stock Performance: A Comprehensive Guide For Investors, enabling investors to make informed decisions and optimize their investment outcomes.

In summary, by following these tips, investors can increase their knowledge, mitigate risks, and leverage opportunities within the dynamic stock market.

Unveiling Armada Gıda's Stock Performance: A Comprehensive Guide For Investors

Understanding a company's stock performance requires examining various key aspects. Exploring Armada Gıda's past and current financial performance, growth potential, industry-specific context, risks associated with investment, and company management's strategy is essential. These factors, presented in more detail below, provide a comprehensive guide to informed investment decisions.

- Historical Financials: Review past revenue, earnings, and cash flow statements to reveal trends.

- Growth Potential: Assess the company's ability to expand its operations and increase profits.

- Industry Analysis: Determine Armada Gıda's competitive landscape, regulatory environment, and economic factors.

- Investment Risks: Identify and evaluate potential risks associated with the company's business model, operations, or financial situation.

- Investor Sentiments: Measure the market's perception of the company's stock through technical analysis and news coverage.

- Management Strategy: Understand the company's leadership's vision, strategy, and operational plans.

By considering these aspects, investors can gain a comprehensive understanding of Armada Gıda's stock performance, make informed decisions, and navigate market fluctuations strategically. This guide provides a roadmap for unlocking the potential value in the company's stock investment opportunities.

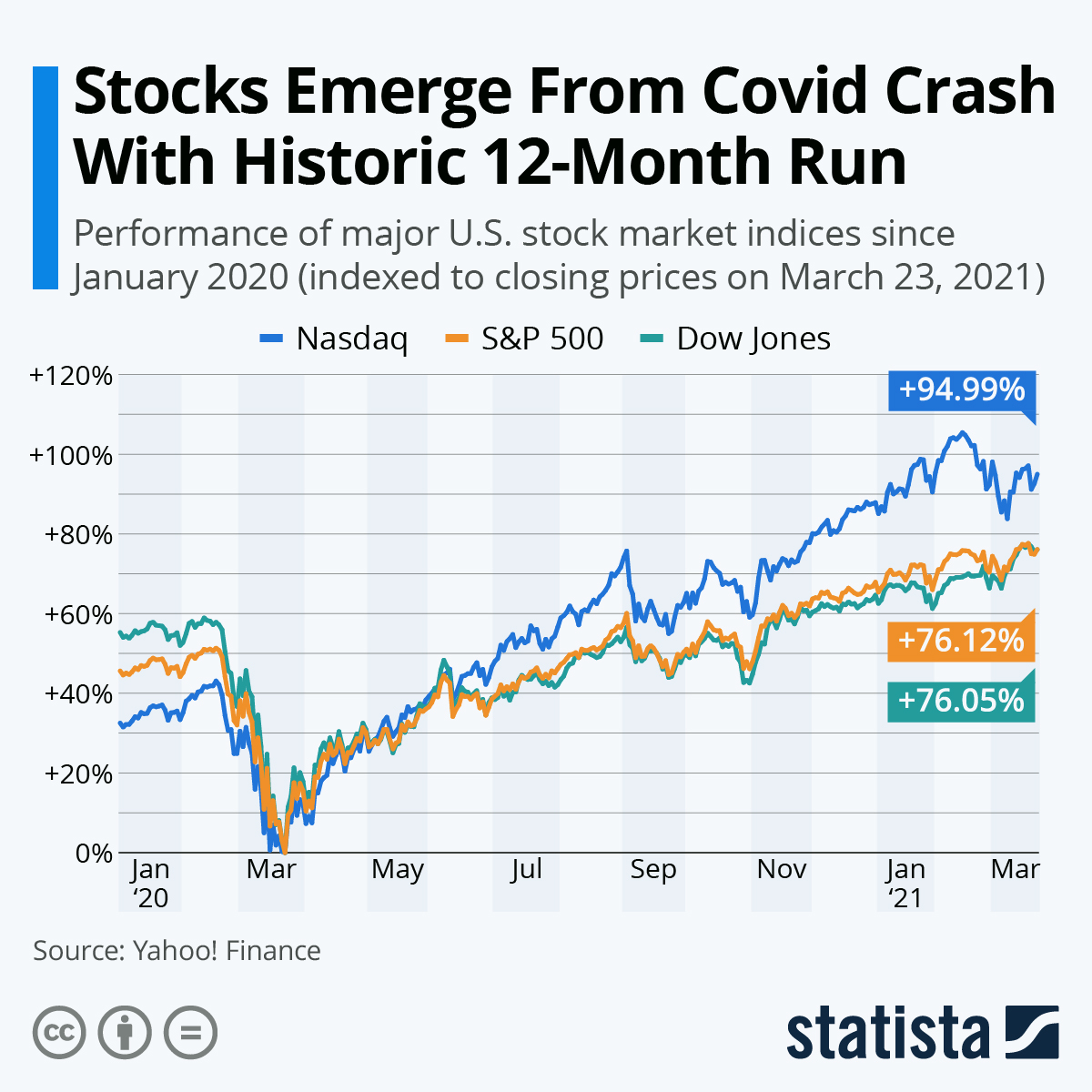

Chart: Stocks Emerge From Covid Crash With Historic 12-Month Run | Statista - Source www.statista.com

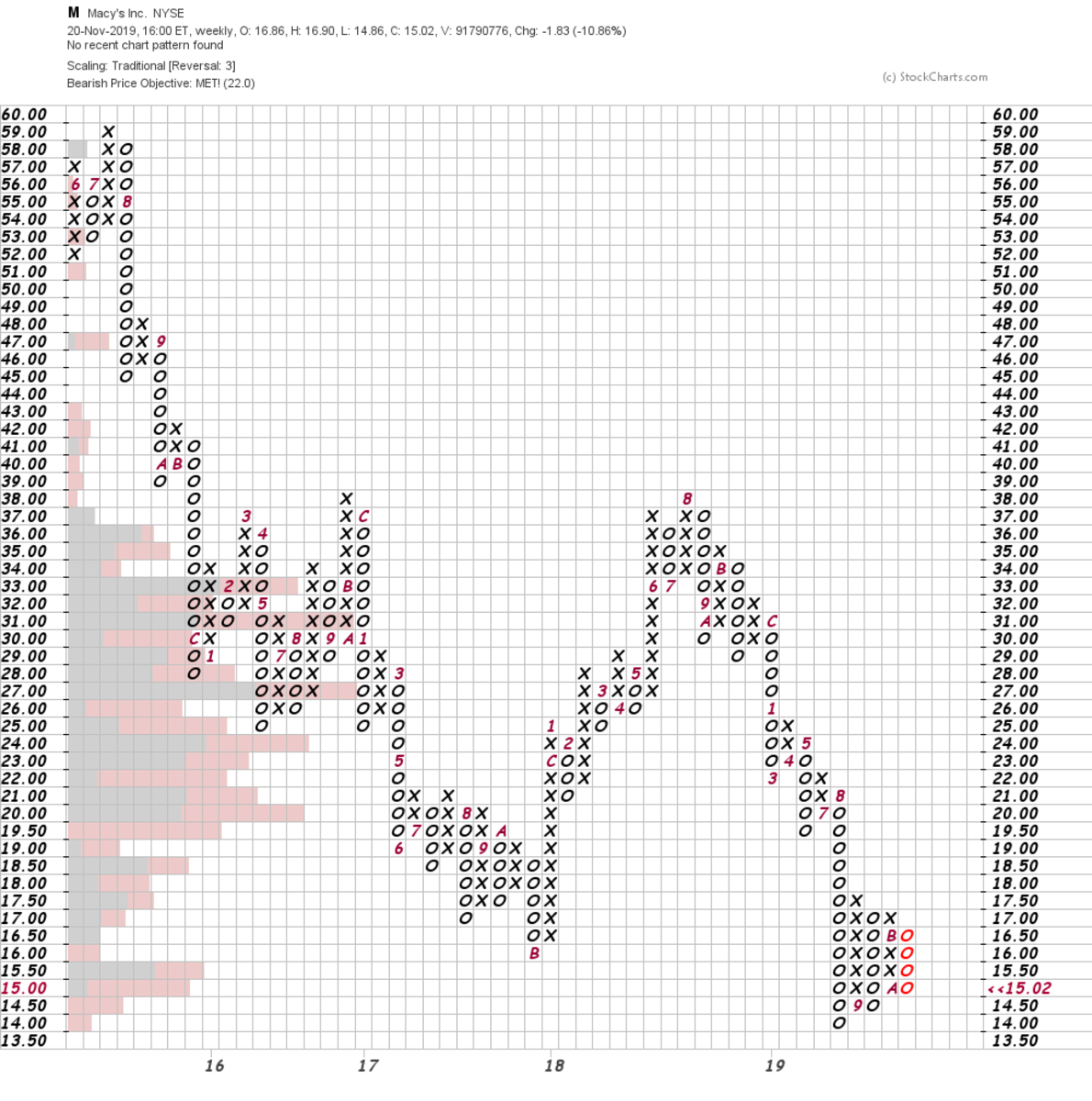

Macy's Stock Performance Is Likely to Remain a Turkey - TheStreet Pro - Source pro.thestreet.com

Unveiling Armada Gıda's Stock Performance: A Comprehensive Guide For Investors

Understanding the intricacies of Armada Gıda's stock performance is paramount for investors seeking to navigate the markets effectively. This guide delves into the factors that shape the company's stock behavior, providing valuable insights into its performance drivers and investment potential.

Pukthuanthong, Kuntara | News Bureau, University of Missouri - Source munewsarchives.missouri.edu

The guide analyzes key indicators such as financial health, market share, and industry trends to provide a comprehensive overview of Armada Gıda's performance. By examining the relationship between these factors and the company's stock price, investors can gain a deeper understanding of the underlying dynamics influencing its value.

The guide further explores the role of external factors such as economic conditions, regulatory changes, and geopolitical events in shaping Armada Gıda's stock performance. By considering the interplay of these elements, investors can assess the potential risks and opportunities associated with investing in the company.

This detailed analysis equips investors with the knowledge and tools necessary to make informed investment decisions. The guide serves as a valuable resource for investors of all levels, providing actionable insights into Armada Gıda's stock performance and its implications for portfolio management.