NEW INFO | Discussing the latest information from various media and various fields

Unlocking Dividends: A Comprehensive Guide To Maximizing Income From Investments

Unlocking Dividends: A Comprehensive Guide To Maximizing Income From Investments

After extensive research and analysis, we have compiled this guide to help you make informed decisions and maximize your dividend income.

In this guide, we will explore:

- Dividend Basics

- Finding Dividend-Paying Stocks

- Evaluating Dividend Yield

- Building a Dividend Portfolio

- Tax Implications of Dividends

Whether you are a seasoned investor or just starting out, this guide will provide you with the insights and strategies you need to unlock the potential of dividend investing.

Premium Photo | Unlocking the Power of Knowledge Management A - Source www.freepik.com

FAQ

This comprehensive guide delves into the intricacies of dividend investing, providing a detailed roadmap to maximize income from investments. To further clarify key concepts, we present a series of frequently asked questions to address common concerns and misconceptions.

Question 1: What are the primary benefits of dividend investing?

Dividend investing offers several advantages: passive income generation, capital appreciation potential, portfolio diversification, and inflation protection. Dividends provide a steady stream of income, while capital appreciation can amplify overall returns. Diversifying into dividend-paying companies spreads risk, and dividends tend to outpace inflation, preserving purchasing power over time.

Question 2: How do I identify high-quality dividend stocks?

To select high-quality dividend stocks, consider factors such as financial stability, consistent dividend growth, a track record of profitability, and reasonable payout ratios. Look for companies with strong balance sheets, positive cash flows, and a history of dividend increases. Avoid companies with excessive debt or highly variable earnings.

Question 3: What is the importance of dividend reinvestment?

Dividend reinvestment is a powerful wealth-building strategy. By reinvesting dividends, investors can acquire additional shares at lower prices, benefiting from compounding returns. Over time, this strategy can significantly increase portfolio value and enhance long-term income potential.

Question 4: When should I consider selling dividend-paying stocks?

Selling dividend-paying stocks should be a deliberate decision based on a change in investment goals or fundamental business conditions. If the company's financials deteriorate, dividend sustainability may be at risk. Consider selling if the stock price becomes significantly overvalued or if alternative investments offer more attractive returns.

Question 5: How do I manage dividend income for tax purposes?

Dividend income is subject to taxation, but strategies exist to minimize tax liability. Tax-advantaged accounts, such as IRAs and 401(k)s, offer tax-deferred or tax-free growth. Additionally, qualified dividends may receive preferential tax treatment. Consult with a tax professional to optimize tax efficiency.

Question 6: What are common misconceptions about dividend investing?

A common misconception is that dividend-paying stocks are only suitable for conservative investors. However, dividend investing can benefit investors of all risk tolerances. Dividends provide stability and income, while capital appreciation can drive long-term growth. Another misconception is that dividend cuts are always negative. While dividend cuts can indicate financial distress, they can also be a strategic move to improve financial health.

In conclusion, dividend investing offers a compelling income-generating strategy. By understanding the key concepts and addressing common concerns, investors can navigate the dividend landscape effectively and maximize their income potential.

For further insights into dividend investing, explore the comprehensive guide: "Unlocking Dividends: A Comprehensive Guide To Maximizing Income From Investments."

Tips

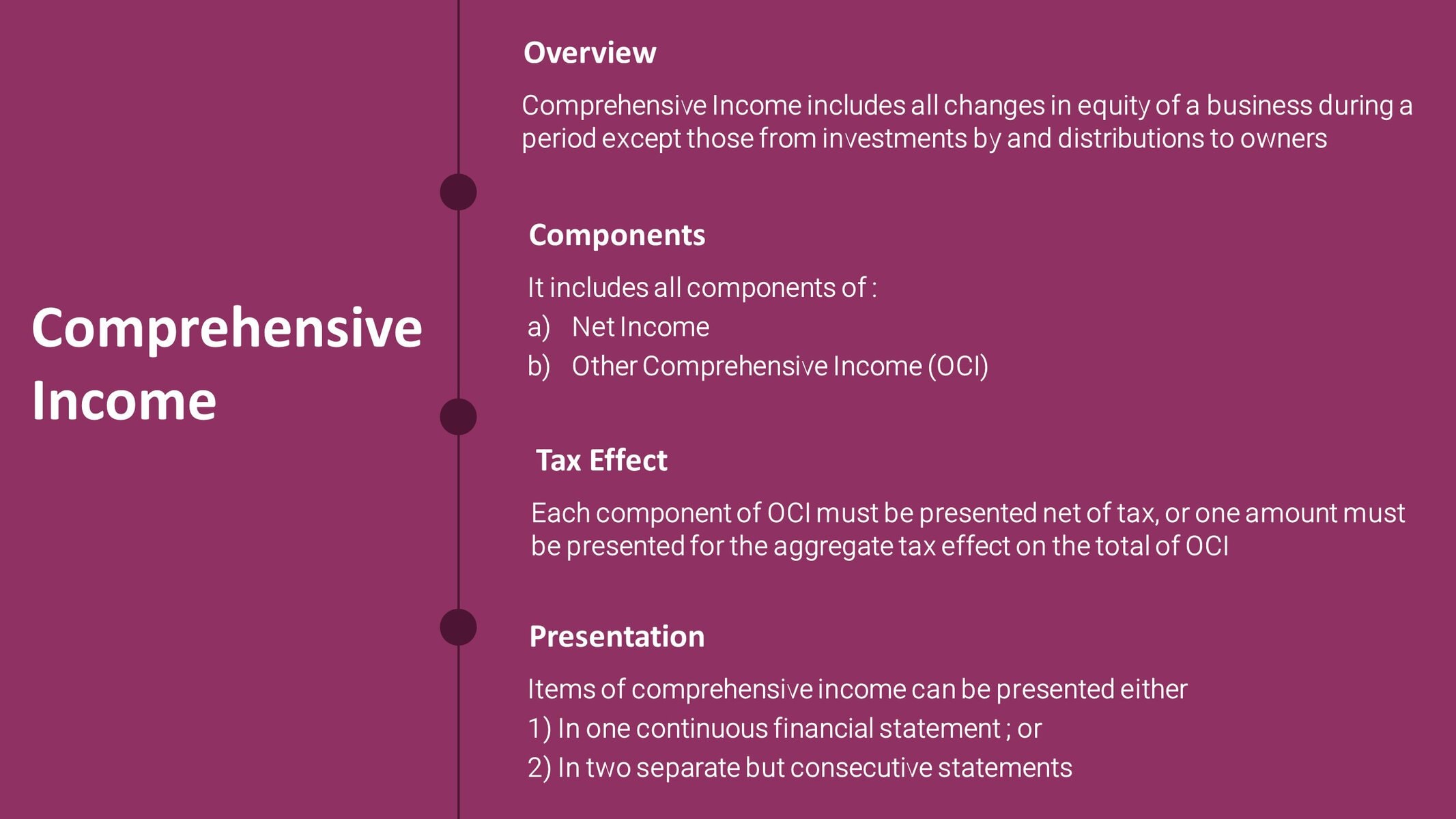

Comprehensive Income | Hemani Financial Solutions - Source hemani.finance

Tip 1: Identify High-Yield Dividend Stocks: Research companies with a history of paying consistent and increasing dividends. Consider factors such as earnings growth, debt-to-equity ratio, and dividend payout ratio.

Tip 2: Invest in Dividend-Paying ETFs: Exchange-traded funds (ETFs) provide diversified exposure to dividend-paying companies within specific sectors or industries. This reduces risk and broadens investment options.

Tip 3: Utilize Dividend Reinvestment Plans (DRIPs): DRIPs automatically reinvest dividends back into the same stock, allowing compounding and potential dividend growth.

Tip 4: Consider Preferred Stocks: Preferred stocks typically offer higher dividend yields than common stocks, but also carry a higher level of risk. Investors should weigh the potential returns against the risks involved.

Tip 5: Monitor Dividend Yield Changes: Dividend yields fluctuate based on market conditions and company performance. Monitor changes to identify opportunities for yield enhancement or potential dividend cuts.

Tip 6: Diversify Dividend Income: Spread investments across various sectors, industries, and companies to reduce risk and ensure a steady stream of dividend income.

Tip 7: Assess Dividend Coverage: Evaluate a company's ability to sustain dividend payments by examining its earnings and cash flow. Dividend coverage is an important indicator of dividend stability.

Tip 8: Consider Tax Implications: Dividends can be subject to different tax rates depending on the type of account they are held in. Consult with a tax advisor to optimize tax efficiency.

Unlocking Dividends: A Comprehensive Guide To Maximizing Income From Investments

In the realm of investing, dividends serve as a lucrative source of passive income. To harness this potential, investors must unlock the dividends that investments offer. This comprehensive guide explores six key aspects crucial for maximizing dividend income.

- Stock Selection: Target companies with consistent dividend payments and growth potential.

- Dividend Yield: Assess the dividend yield relative to prevailing interest rates and company fundamentals.

- Dividend Reinvestment Plans (DRIPs): Automatically reinvest dividends into more shares, compounding returns.

- Tax Efficiency: Explore tax-advantaged accounts like IRAs and Roth IRAs for dividend income.

- Dividend Growth: Prioritize companies that increase dividends over time, boosting income.

- Market Conditions: Monitor economic and market factors that can impact dividend payments.

These key aspects provide a roadmap for unlocking the full potential of dividend income. By selecting companies with sustainable dividend policies, understanding dividend yields, and utilizing DRIPs, investors can enhance their income-generating capabilities. Tax-efficient investing and monitoring market conditions further optimize dividend strategies. Moreover, focusing on companies with a history of dividend growth ensures a consistent and potentially growing stream of passive income.

Maximizing Online Income with ChatGPT: A Comprehensive Guide eBook by - Source www.kobo.com

Unlocking Dividends: A Comprehensive Guide To Maximizing Income From Investments

Understanding the connection between dividends and income maximization is crucial for investors seeking to generate a stable and growing stream of income from their investments. Dividends are distributions of a company's profits to its shareholders, and they play a significant role in enhancing the overall return on investment.

Maximizing Insurance Agent Income: Unlocking the Real Potential | Smart - Source www.smartchoiceagents.com

Maximizing dividend income involves careful selection of dividend-paying stocks, considering factors such as dividend yield, dividend payout ratio, and the company's financial health. It also requires a long-term investment horizon, as dividends tend to grow over time. By reinvesting dividends received, investors can further compound their returns and accelerate their wealth accumulation.

Practical applications of this understanding include creating a diversified dividend portfolio, utilizing dividend reinvestment plans (DRIPs), and actively monitoring dividend-paying companies to ensure their financial stability and growth potential. Understanding the impact of dividends on investment returns empowers investors to make informed decisions, optimize their income generation strategies, and achieve their financial goals.

| Strategy | Description |

|---|---|

| Dividend Stock Selection | Identify companies with a history of consistent dividend payments, a reasonable dividend yield, and a sound financial position. |

| Dividend Reinvestment | Reinvest dividends received to purchase additional shares, compounding returns over time. |

| Portfolio Diversification | Spread investments across multiple dividend-paying stocks to reduce risk and enhance stability. |

| Active Monitoring | Monitor dividend-paying companies regularly to assess their financial performance and dividend sustainability. |

Conclusion

Unlocking the potential of dividends requires a comprehensive approach that encompasses stock selection, dividend reinvestment, portfolio diversification, and active monitoring. By harnessing the power of dividends, investors can maximize their income potential, build a growing stream of passive income, and achieve their long-term financial objectives.

Remember, dividend investing is a long-term strategy that requires patience and a disciplined approach. By embracing the principles outlined in this article, investors can increase their understanding of dividends, make informed investment decisions, and unlock the full potential of their dividend-paying investments.