NEW INFO | Discussing the latest information from various media and various fields

Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization

Understanding National Insurance can be made easy with "Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization"!

_Editor's Note: "Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization" has published today to provide an in-depth understanding about National Insurance including how to optimise your contributions and benefits._

Our team have put together this comprehensive guide to help you make the most of the National Insurance system, ensuring compliance and maximizing your benefits.

Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization can support target audience in many ways that it is unable to do without having the knowledge.

| National Insurance | Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization |

|---|---|

| The National Insurance system is a complex one, and it can be difficult to understand how it works. | Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization is a detailed guide that explains the National Insurance system in a clear and concise way. |

| As a result, many people end up paying more National Insurance than they need to. | Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization can help you avoid this by showing you how to optimize your National Insurance contributions. |

| Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization is written by experts in the field. As a result, you can be sure that the information is accurate and up-to-date. | The guide is also regularly updated to reflect changes in the National Insurance system. |

FAQ

Secure a comprehensive understanding of National Insurance with answers to commonly encountered questions, empowering businesses with the necessary knowledge for compliance and optimization.

.jpg)

SEO Optimization Comprehensive Guide E-Book PLR — Digital PLR Store - Source digitalplr.store

Question 1: What is National Insurance, and who is liable to pay it?

National Insurance is a social security contribution system within the United Kingdom that provides benefits such as healthcare, unemployment, and pensions. Employed and self-employed individuals, as well as employers, are responsible for contributing to the system based on their income and employment status.

Question 2: How are National Insurance contributions calculated and paid?

National Insurance contributions are calculated as a percentage of an individual's earnings, with different rates applicable to different categories of income. Contributions are typically deducted directly from wages or self-employment profits before taxes, with employers responsible for remitting the combined employer and employee contributions to HMRC.

Question 3: What are the different classes of National Insurance and their respective purposes?

National Insurance is divided into three main classes: Class 1 for employees, Class 2 for self-employed individuals, and Class 4 for profits from self-employment exceeding a certain threshold. Each class has specific contribution rates and eligibility criteria.

Question 4: Are there any exemptions or reliefs available to reduce National Insurance liability?

Yes, certain exemptions and reliefs may be available to reduce National Insurance contributions in specific circumstances. These include exemptions for individuals under a certain age or income threshold, as well as reliefs for employers hiring young employees or investing in research and development.

Question 5: What are the consequences of failing to pay National Insurance contributions?

Failure to pay National Insurance contributions can result in penalties, interest charges, and potential legal action by HMRC. It can also impact an individual's eligibility for state benefits and may hinder their ability to access essential services.

Question 6: How can businesses optimize their National Insurance contributions?

Businesses can optimize their National Insurance contributions by understanding the various classes and contribution rates, exploring available exemptions and reliefs, and implementing tax-efficient strategies such as salary sacrifice schemes or pension contributions.

Remember, staying informed about National Insurance is crucial for businesses to ensure compliance, optimize their contributions, and support the UK's social security system.

Transition to the next article section.

Tips

Mastering National Insurance (NI) is crucial for businesses and individuals to ensure compliance and optimize contributions. Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization offers invaluable insights into the NI system, providing practical tips to enhance compliance and maximize benefits.

Content Optimization For Insurance Companies - Insurance Navy Brokers - Source www.insurancenavy.com

Tip 1: Determine NI Liability

Identify which employees are subject to NI contributions based on their employment status, income, and age. Correctly classifying employees ensures accurate NI payments and avoids potential penalties.

Tip 2: Calculate NI Contributions

Calculate NI contributions using the correct rates and thresholds. Understanding the Class system and different contribution rates for employees and employers is essential to ensure accurate payments.

Tip 3: Manage NI Payments

Establish a robust system for timely NI payments. Explore options such as Direct Debit, online banking, or payment software to automate the process and minimize the risk of late payments.

Tip 4: Utilize NI Reliefs and Exemptions

Take advantage of NI reliefs and exemptions to reduce NI liability. These include exemptions for certain income types, such as Statutory Maternity Pay, and reliefs for businesses with low profits.

Tip 5: Keep Accurate Records

Maintain detailed records of NI contributions, including employee payroll information, payment receipts, and any relevant correspondence with HMRC. Accurate records facilitate compliance audits and provide evidence in case of disputes.

Tip 6: Stay Informed of NI Changes

NI legislation is subject to periodic updates and revisions. Regularly review HMRC guidance and industry news to stay informed about changes and ensure compliance with the latest regulations.

Tip 7: Consider NI Optimization Strategies

Explore strategies to optimize NI contributions within the boundaries of the law. This may involve restructuring employee compensation, utilizing salary sacrifice schemes, or reviewing the use of contractors.

Tip 8: Seek Professional Advice If Needed

If you encounter complex NI issues or require personalized guidance, consider seeking professional advice from a qualified accountant or tax advisor. Their expertise can help ensure compliance and optimize NI strategies.

By implementing these tips, businesses and individuals can enhance their understanding of NI, streamline compliance processes, and maximize benefits under the NI system.

Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization

National Insurance is a vital component of the UK's social security system, contributing significantly to the funding of public services. To ensure compliance and optimize its benefits, a thorough understanding of its key aspects is essential.

AML Compliance Reporting: A Comprehensive Guide - Source youverify.co

- Statutory Contributions: Understanding the legal obligation to pay National Insurance.

- Eligibility Criteria: Determining who is required to pay National Insurance.

- Contribution Rates: Familiarizing with the various National Insurance contribution rates.

- Tax Treatment: Recognizing the tax implications of National Insurance payments.

- Benefits Entitlement: Exploring the range of benefits accessible through National Insurance.

- Compliance and Penalties: Ensuring adherence to National Insurance regulations to avoid penalties.

These aspects are interconnected, shaping the overall framework of National Insurance. For instance, knowing your eligibility criteria ensures you fulfill your statutory obligations. Understanding contribution rates enables you to budget effectively, while awareness of tax treatment optimizes your financial planning.

Understanding AML Compliance: A Comprehensive Guide - Source complyfactor.com

Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization

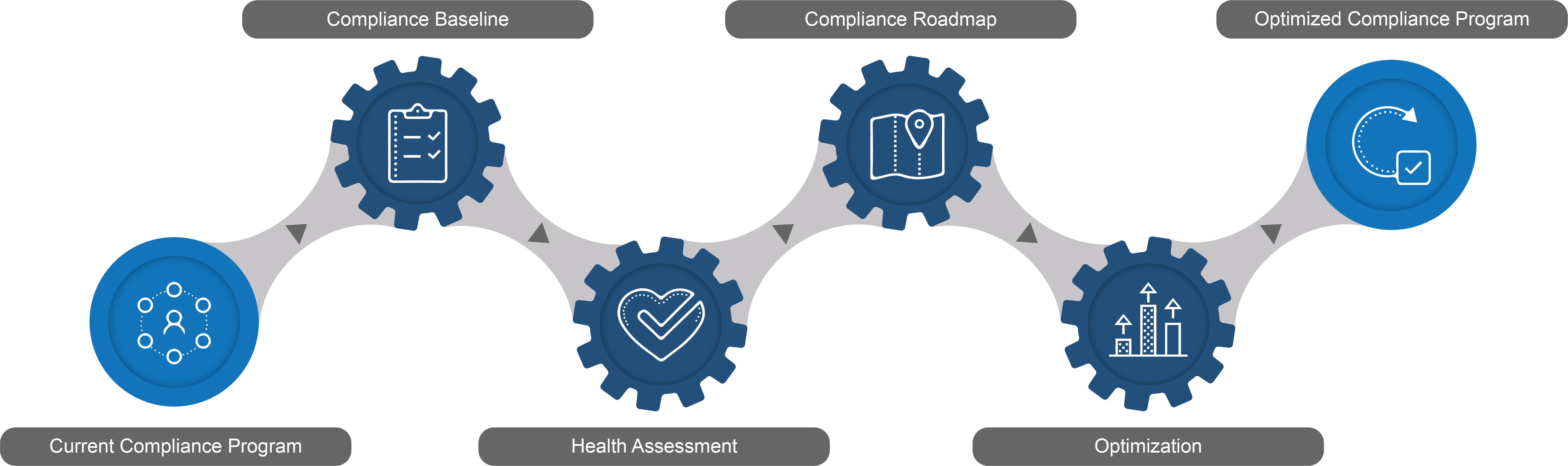

"Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization" provides a deep dive into the complex world of National Insurance contributions, exploring their multifaceted nature and impact on individuals and businesses. This guide unveils the intricacies of the National Insurance system, empowering readers to navigate its complexities with confidence. By demystifying the jargon and simplifying the processes, it enables organizations to optimize their National Insurance contributions, ensuring compliance and maximizing efficiency.

Optimizing Trade Compliance Processes | Vigilant GTS - Source www.vigilantgts.com

The significance of this comprehensive guide lies in its ability to streamline National Insurance management, minimizing the risk of errors or overpayments. It equips readers with the knowledge and tools to accurately calculate contributions, ensuring compliance with HMRC regulations. Moreover, the guide highlights potential areas for optimization, allowing businesses to reduce their National Insurance liability without compromising their obligations.

In today's dynamic business environment, a clear understanding of National Insurance is crucial for financial planning and risk management. This guide serves as an invaluable resource for accountants, payroll professionals, and business owners alike, providing a roadmap for optimizing contributions and ensuring compliance with HMRC regulations.

| Key Insight | Practical Significance |

|---|---|

| Accurate Calculation of Contributions | Avoids penalties and interest charges, ensuring compliance |

| Timely Payment of Contributions | Prevents disruption of business operations and maintains a positive relationship with HMRC |

| Identification of Optimization Opportunities | Reduces National Insurance liability, improving cash flow and profitability |

| Understanding of HMRC Regulations | Ensures compliance, minimizing the risk of audits and penalties |

Conclusion

The "Understanding National Insurance: A Comprehensive Guide For Compliance And Optimization" serves as an indispensable resource for navigating the intricacies of National Insurance contributions. By providing a clear understanding of the system and its implications, this guide empowers individuals and businesses to optimize their National Insurance management, ensuring compliance and maximizing efficiency.

In an era of complex tax regulations, this guide is a beacon of clarity, enabling readers to navigate the complexities of National Insurance with confidence. By arming themselves with the knowledge and tools provided in this guide, organizations can stay ahead of the curve, ensuring compliance and optimizing their financial performance.