NEW INFO | Discussing the latest information from various media and various fields

UK Markets: Comprehensive Overview, News, And Analysis

Gain the latest insights into the UK's financial landscape with "UK Markets: Comprehensive Overview, News, And Analysis," your ultimate source for market developments, expert insights, and real-time updates.

Editor's Notes: "UK Markets: Comprehensive Overview, News, And Analysis" has been released today (May 4, 2023), providing time-sensitive information on the UK market for those looking to make informed investment decisions.

We've dedicated countless hours to analyzing, researching, and compiling data to bring you this comprehensive guide. Whether you're a seasoned investor or just starting out, our goal is to equip you with the knowledge you need to successfully navigate the UK markets.

Key Insights:

FAQ

This FAQ section provides concise answers to frequently asked questions and addresses common misconceptions regarding the UK markets, offering valuable insights for informed decision-making.

Technical Analysis of the Financial Markets - John J. Murphy | Thuprai - Source thuprai.com

Question 1: What are the key indices used to track the performance of the UK stock market?

The FTSE 100 Index, FTSE 250 Index, and FTSE All-Share Index are widely used to monitor the overall performance and trends of the UK stock market.

Question 2: What factors influence the performance of the UK markets?

Economic indicators, political stability, interest rate decisions, global economic conditions, and market sentiment all play significant roles in shaping the performance of the UK markets.

Question 3: How can I invest in the UK markets?

Investors can access the UK markets through various channels, including online trading platforms, brokers, and investment funds, allowing for tailored portfolio diversification.

Question 4: What are the advantages of investing in the UK markets?

The UK markets offer a stable regulatory environment, a diverse range of investment opportunities, and potential exposure to global economic growth, providing investors with a balanced risk-reward profile.

Question 5: What are the risks associated with investing in the UK markets?

Market volatility, currency fluctuations, political uncertainty, and economic downturns are inherent risks that investors should be aware of when considering investments in the UK markets.

Question 6: How do I stay informed about the latest developments in the UK markets?

Regularly monitoring reputable news sources, reading market analysis, and utilizing industry reports help investors stay up-to-date on market trends and make informed decisions.

By addressing these common questions and clarifying misconceptions, this FAQ section equips readers with a solid foundation for understanding the dynamics of the UK markets.

For further exploration and in-depth analysis, we encourage you to delve into the comprehensive articles and insights available on our website.

Tips - UK Markets: Comprehensive Overview, News, And Analysis

Maximize your UK market knowledge with these valuable tips.

Tip 1: Stay informed about economic indicators.

Economic indicators, such as GDP growth, inflation, and unemployment rates, provide valuable insights into the overall health of the UK economy. By monitoring these indicators, investors can make informed decisions about where to allocate their assets.

Tip 2: Understand the political landscape.

Political decisions can significantly impact the UK markets. Investors should stay abreast of the latest political developments, such as elections, changes in government policy, and Brexit negotiations, to anticipate how they might affect market behavior.

Tip 3: Diversify your portfolio.

Diversification is key to managing risk in the UK markets. Investors should spread their investments across different asset classes, such as stocks, bonds, and real estate, to minimize the impact of volatility in any one sector.

Tip 4: Consider investing in UK-focused ETFs.

Exchange-traded funds (ETFs) offer a convenient way to invest in a basket of UK stocks or bonds. ETFs provide diversification and can be bought and sold like individual stocks.

Tip 5: Monitor the currency markets.

The value of the pound sterling against other currencies can impact the returns on investments in UK markets. Investors should pay attention to currency movements and consider hedging strategies to protect against potential losses.

Summary

By following these tips, investors can enhance their understanding of the UK markets and make more informed investment decisions. For more comprehensive insights, refer to UK Markets: Comprehensive Overview, News, And Analysis.

UK Markets: Comprehensive Overview, News, And Analysis

UK markets encompass a diverse range of investment opportunities, offering a comprehensive overview of the UK's financial landscape. They provide real-time news, insightful analysis, and in-depth market research to empower investors with informed decision-making.

- Economic Indicators: Monitoring GDP, inflation, and consumer confidence.

Financial Markets And Institutions | DEPARTMENT OF FINANCE AND ACCOUNTING - Source financeaccounting.uonbi.ac.ke - Stock Market Performance: FTSE 100, FTSE 250, and sector-specific indices.

- Currency Markets: GBP exchange rates against major currencies.

- Bond Markets: Gilts, corporate bonds, and yields.

- Property Markets: House prices, rental yields, and market trends.

- Commodities: Oil, gas, and precious metals trading on UK exchanges.

These key aspects collectively provide a comprehensive understanding of the UK markets. Economic indicators gauge the overall health of the economy, while stock market performance reflects investor sentiment and corporate profitability. Currency markets indicate the strength of the pound and impact trade and investment. Bond markets offer insights into interest rate expectations and government borrowing costs. Property markets affect consumer wealth and investment decisions. Finally, commodities trading provides diversification and exposure to global economic factors. By considering these aspects, investors can navigate the UK markets with confidence and make informed choices that align with their financial goals.

UK Markets: Comprehensive Overview, News, And Analysis

The UK markets are a complex and ever-changing landscape, with a wide range of factors influencing their performance. These include economic data, political events, and global market trends. In order to make informed investment decisions, it is essential to have a comprehensive understanding of the UK markets. This includes being aware of the latest news and analysis, as well as having a deep understanding of the underlying factors that drive market performance.

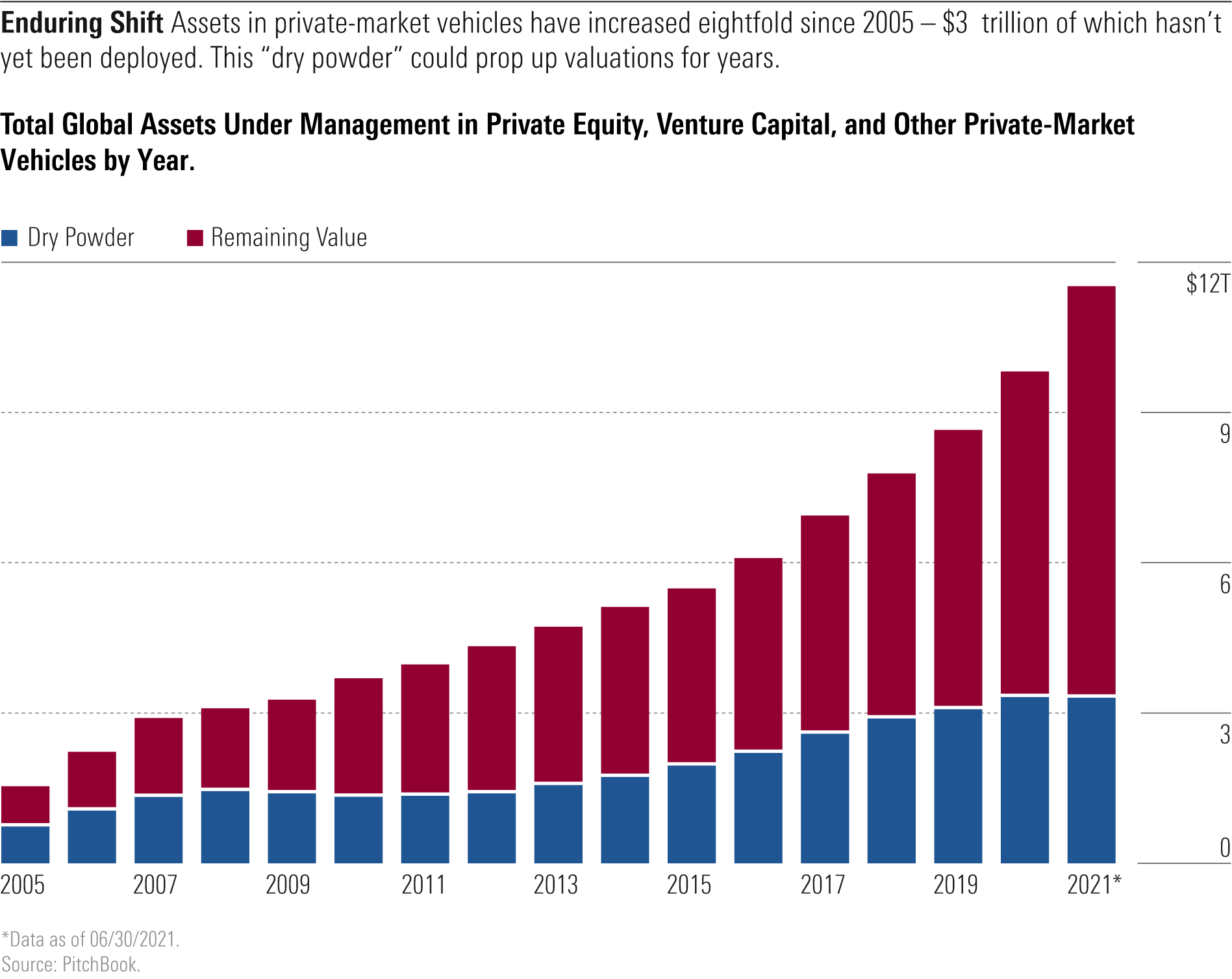

Public/Private Markets | Morningstar - Source www.morningstar.com

There are a number of resources available to help investors stay up-to-date on the UK markets. These include financial news websites, investment blogs, and research reports. It is also important to follow the latest economic data and political events, as these can have a significant impact on market performance. By taking the time to understand the UK markets, investors can make more informed investment decisions and achieve their financial goals.