NEW INFO | Discussing the latest information from various media and various fields

Tlt Stock: Understanding Treasury Long Bond ETF Trends And Strategies

```html

Tlt Stock: Understanding Treasury Long Bond ETF Trends And Strategies

In the current financial landscape, understanding Tlt Stock: Understanding Treasury Long Bond ETF Trends And Strategies has become increasingly crucial for investors seeking to navigate the complexities of bond markets.

Editor's Notes: Tlt Stock: Understanding Treasury Long Bond ETF Trends And Strategies" have published today date. By Analyzing all available reports and after combining their findings, our team has developed this Tlt Stock: Understanding Treasury Long Bond ETF Trends And Strategies guide to help investors make the best possible choices. Understanding how this type of ETF works can help investors make informed decisions about their portfolios.

We've analyzed and collected all available information about the Tlt Stock: Understanding Treasury Long Bond ETF Trends And Strategies, and in this guide, we will cover everything investors need to know.

Key differences or Key takeaways

| Key takeaway 1 | Summary of key takeaway 1 |

| Key takeaway 2 | Summary of key takeaway 2 |

```

FAQs on TLT Stock

This section addresses common questions and misconceptions surrounding the Treasury Long Bond ETF (TLT). These FAQs aim to provide clarity and enhance understanding of TLT stock and its related strategies.

Amundi US Treasury Bond Long Dated UCITS ETF GBP Hedged Dist: Net Asset - Source headtopics.com

Question 1: What is TLT Stock?

TLT is an exchange-traded fund (ETF) that tracks the performance of U.S. Treasury long-term bonds with maturities greater than 20 years. It offers exposure to the fixed income market, providing investors with a diversified way to potentially benefit from rising bond prices and interest rate fluctuations.

Question 2: How can I invest in TLT Stock?

TLT can be bought and sold like any other stock on major exchanges such as the New York Stock Exchange (NYSE). Investors can purchase shares of TLT through their preferred brokerage accounts or financial advisors.

Question 3: What are the benefits of investing in TLT Stock?

TLT offers several potential benefits, including:

- Exposure to the U.S. Treasury bond market, considered one of the safest investments available.

- Diversification of portfolios, reducing overall risk.

- Potential for income generation through regular dividend payments.

Question 4: What are the risks associated with investing in TLT Stock?

Like all investments, TLT stock carries certain risks. These include:

- Interest rate risk: Bond prices tend to move inversely to interest rates. Rising interest rates can result in a decline in TLT's value.

- Inflation risk: Inflation can erode the value of bonds over time.

- Market volatility: The price of TLT can fluctuate based on overall market conditions.

Question 5: How can I use TLT Stock as part of my investment strategy?

TLT can be incorporated into various investment strategies. It can serve as a defensive component, providing stability during market downturns. It can also be used tactically to potentially capitalize on interest rate expectations.

Question 6: What are some alternative investment options to TLT Stock?

Investors seeking exposure to fixed income markets may consider alternative options such as other bond ETFs, individual bonds, or fixed income mutual funds. These alternatives may offer varying degrees of risk and return, allowing investors to tailor their investment choices to their specific goals and risk tolerance.

By understanding these key questions and considerations, investors can make informed decisions regarding the potential role of TLT stock within their investment portfolios.

Next: Explore Strategies for Investing in TLT...

Tips

Now is the time to read the article Tlt Stock: Understanding Treasury Long Bond ETF Trends And Strategies and find out all about it.

-

Tip 1: Track macroeconomic factors that influence Treasury bond yields

Economic growth, inflation, and fiscal policy affect the value of Treasury bonds, so it's crucial to monitor these factors closely.

Tip 2: Analyze supply and demand dynamics in the Treasury bond market

When the supply of Treasury bonds exceeds demand, yields typically rise. Conversely, when demand outstrips supply, yields tend to fall.

Tip 3: Stay updated on the Federal Reserve's monetary policy decisions

The Fed's interest rate hikes and quantitative easing measures directly impact Treasury bond yields.

Tip 4: Consider investing in Treasury ETFs over individual bonds

ETFs provide diversification, lower transaction costs, and real-time pricing, making them a convenient alternative to buying individual Treasury bonds.

Tip 5: Monitor the term structure of interest rates

The yield curve, which plots yields across different maturities, can provide insights into future interest rate expectations.

Tip 6: Incorporate TLT into a balanced portfolio

Treasury long-term bonds can provide stability and diversification to portfolios, balancing riskier asset classes.

By following these tips, you can gain a deeper understanding of Treasury long bond ETF trends and strategies, enabling you to make informed investment decisions.

Tlt Stock: Understanding Treasury Long Bond ETF Trends And Strategies

Treasury Long Bond ETFs are influential securities that provide exposure to the long-term U.S. Treasury bond market. Understanding their trends and strategies can empower investors to make informed decisions about their portfolios.

- Yield Curve: TLT follows the yield curve, with its price inversely related to interest rates.

- Macroeconomic Factors: Economic indicators like inflation and GDP affect TLT's value.

- Federal Reserve Policy: Fed interest rate decisions and quantitative easing can impact TLT's performance.

- Credit Quality: TLT invests in highly-rated Treasuries, providing a haven during market downturns.

- Diversification: TLT offers diversification for portfolios, reducing exposure to single-issuer risk.

- Strategy: Buy-and-hold or tactical trading can be used to capitalize on TLT's trends.

The key aspects of TLT stock are interconnected. For instance, the yield curve and macroeconomic factors determine interest rates, which impact TLT's price. Additionally, Federal Reserve policy can influence both interest rates and macroeconomic conditions, indirectly affecting TLT. By understanding these relationships, investors can better navigate the ETF's trends and develop effective strategies aligned with their financial goals.

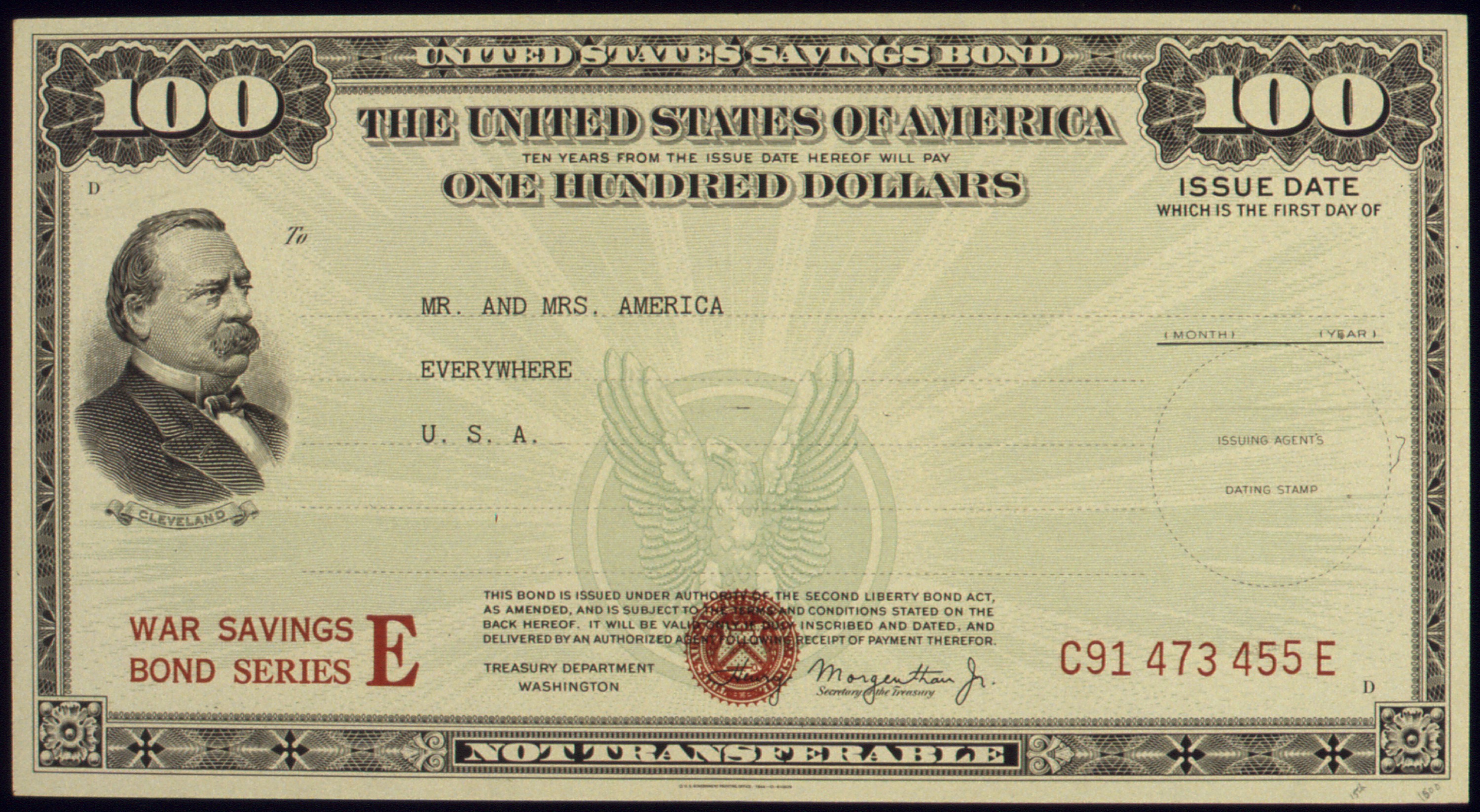

The Name’s Bond, Treasury Bond – Options Edge - Source theoptionsedge.com

Tlt Stock: Understanding Treasury Long Bond ETF Trends And Strategies

Treasury Long Bond (TLT) is an exchange-traded fund (ETF) that tracks the performance of long-term U.S. Treasury bonds. As such, it provides investors with exposure to the interest rate risk associated with long-term bonds. Understanding the trends and strategies related to TLT stock is crucial for investors seeking diversification and managing risk within their portfolios.

Treasury Yields: A Long-Term Perspective | ETF Trends - Source www.etftrends.com

One of the key factors influencing TLT stock is the Federal Reserve's monetary policy. The Fed's decisions regarding interest rates can significantly impact the prices of long-term bonds. When the Fed raises rates, it becomes more expensive for the government to borrow money, leading to a decrease in bond prices. Conversely, when the Fed lowers rates, bond prices tend to rise.

Another factor affecting TLT stock is inflation. Inflation erodes the purchasing power of money, making long-term bonds less attractive to investors. As a result, inflation can lead to a decline in TLT stock prices.

Understanding these factors is essential for developing effective strategies when investing in TLT stock. Investors should consider their risk appetite, time horizon, and investment goals when making investment decisions. Diversification across different asset classes and within the bond market can help mitigate risk.

TLT stock provides investors with a convenient and cost-effective way to access the long-term bond market. By understanding the trends and strategies associated with TLT, investors can make informed decisions and potentially enhance their portfolio performance.

| Factor | Impact on TLT Stock |

|---|---|

| Federal Reserve's monetary policy | Interest rate changes affect bond prices |

| Inflation | Erodes purchasing power, making long-term bonds less attractive |

Conclusion

Understanding the trends and strategies associated with TLT stock is crucial for investors seeking exposure to the long-term bond market. By considering factors such as interest rates and inflation, investors can make informed decisions that align with their risk tolerance and investment objectives. Diversification and ongoing monitoring are essential for successful long-term investing in TLT stock.

As the bond market continues to evolve, investors should stay informed about the latest trends and economic developments. By doing so, they can position their portfolios to navigate market fluctuations and achieve their financial goals.