NEW INFO | Discussing the latest information from various media and various fields

The Actual Cost Of Minimum Wage: A Comprehensive Guide For Employers

The cost of minimum wage: a comprehensive guide for employers, is an important topic that is getting a lot of attention these days.

Editor's Notes: The Actual Cost Of Minimum Wage: A Comprehensive Guide For Employers have published today date to talk about this topic comprehensively.

We've done some analysis and digging, and we've come up with this user guide to help you make the right decision for your business.

Here are some of the key differences between the two approaches before we explore the main article topics.:

| The Actual Cost of Minimum Wage | The Comprehensive Guide for Employers | |

|---|---|---|

| Length | Short and sweet | In-depth and comprehensive |

| Content | Focuses on the costs of minimum wage | Covers everything employers need to know about minimum wage |

| Purpose | To help employers understand the costs of minimum wage | To help employers comply with minimum wage laws |

As you can see, the two approaches have different strengths and weaknesses.

The Actual Cost of Minimum Wage is a good option if you're looking for a quick and easy read that will give you a basic understanding of the costs of minimum wage.

The Comprehensive Guide for Employers is a better option if you're looking for a more in-depth look at minimum wage laws and how they affect employers.

No matter which approach you choose, it's important to understand the costs of minimum wage before making any decisions for your business.

FAQ

Understanding the actual cost of minimum wage is crucial for employers. This FAQ guide provides answers to common questions and misconceptions regarding minimum wage calculations and its impact on businesses.

Question 1: What is included in the actual cost of minimum wage?

The actual cost of minimum wage comprises not only the hourly wage but also additional expenses associated with hiring employees. This includes payroll taxes, health insurance premiums, paid time off, and other employee benefits.

Minimum Wage 2024 Nsw - Raf Maggie - Source rainayelinore.pages.dev

Question 2: How can employers minimize the actual cost of minimum wage?

Minimizing the actual cost of minimum wage requires a multifaceted approach. Options include optimizing labor scheduling, providing employee training and development programs, and exploring tax incentives and credits.

Question 3: What are the long-term implications of paying minimum wage?

Long-term consequences of paying minimum wage include potential employee turnover, reduced productivity, and reputational damage. Investing in a competitive compensation package can mitigate these risks and contribute to a positive work environment.

Question 4: Does the minimum wage vary across different industries or locations?

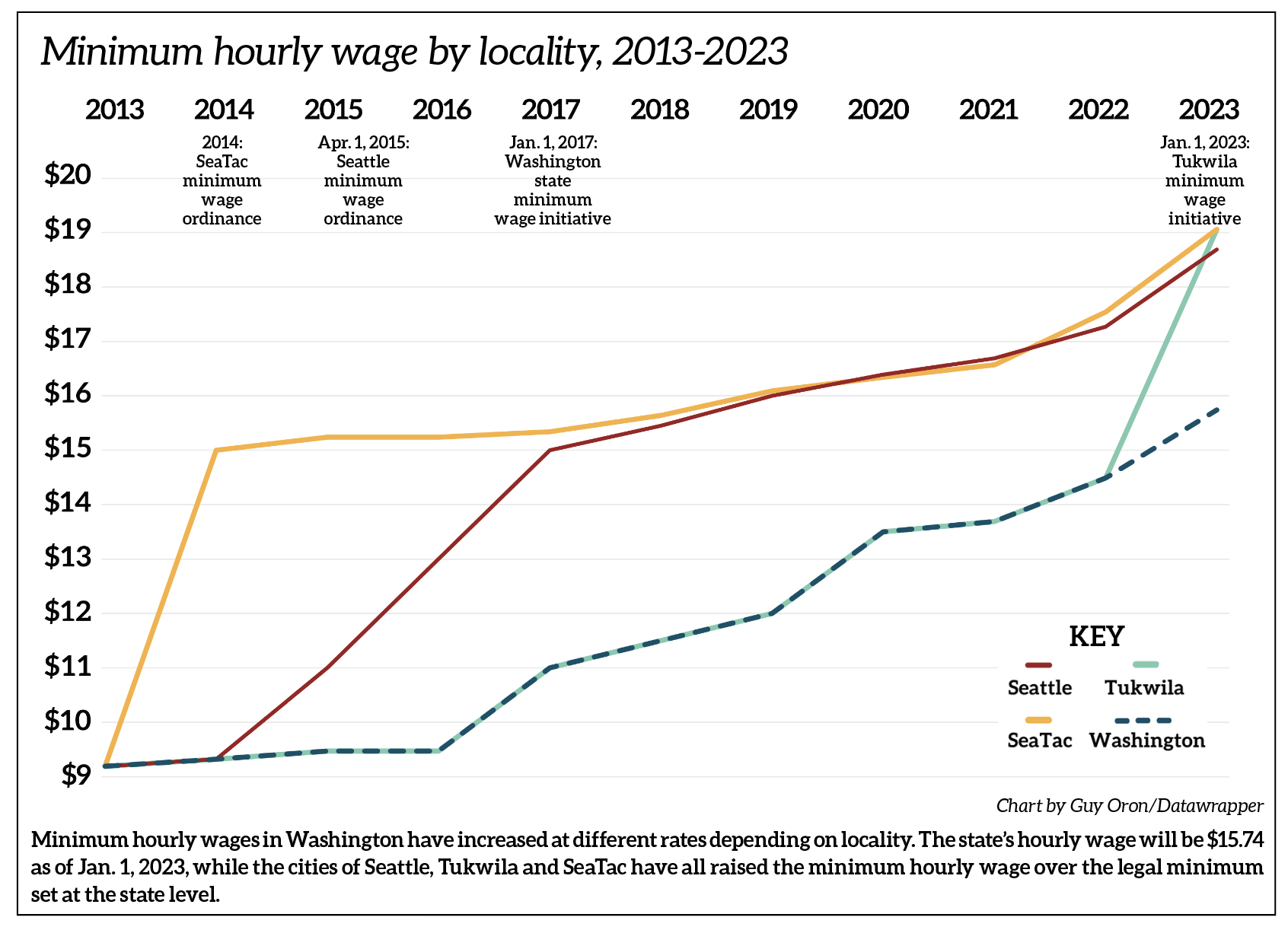

Yes, the minimum wage can vary depending on the industry, region, and locality where the employee works. Employers must stay informed about specific minimum wage regulations applicable to their businesses.

Question 5: How does the minimum wage affect small businesses?

Small businesses face unique challenges when implementing minimum wage requirements. They should carefully consider cost impacts and explore strategies for minimizing expenses while maintaining profitability.

Question 6: What are the ethical implications of paying minimum wage?

Paying minimum wage raises ethical considerations regarding the fairness of compensation and the impact on employee well-being. Employers should strive to provide a living wage that supports basic human needs and fosters a sense of dignity and respect.

Summary of key takeaways or final thought:

Calculating the actual cost of minimum wage involves considering additional expenses beyond the hourly rate. Minimizing costs through strategic measures can help businesses maintain profitability. The long-term implications of minimum wage require careful consideration, as do industry and location-specific regulations. Ethical considerations should guide employers in providing fair and sustainable compensation.

Transition to the next article section:

Tips

Paying minimum wage can impact more than just employee salaries. Explore additional costs associated with a minimum wage increase in The Actual Cost Of Minimum Wage: A Comprehensive Guide For Employers.

Tip 1: Employee turnover

When employees are paid less than a living wage, they are more likely to seek employment elsewhere. This can lead to high turnover rates, which can be costly for businesses in terms of recruiting and training new employees.

Tip 2: Absenteeism

Employees who are struggling financially are more likely to miss work due to illness or other personal issues. This can lead to lost productivity and increased costs for businesses.

Tip 3: Reduced morale

Employees who are paid less than a living wage are less likely to be motivated and engaged in their work. This can lead to decreased productivity and increased costs for businesses.

Manila Minimum Wage in Manila 2024: A Comprehensive Overview | SunFish - Source dataon.ph

Tip 4: Increased healthcare costs

Employees who are paid less than a living wage are more likely to rely on government assistance programs such as Medicaid. This can lead to increased costs for taxpayers.

Tip 5: Reduced economic growth

When employees are paid less than a living wage, they have less money to spend on goods and services. This can lead to reduced economic growth.

The tips above highlight some of the additional costs that businesses may incur as a result of paying minimum wage. These costs should be taken into account when making decisions about wage levels.

For more information on the actual cost of minimum wage, please refer to the article The Actual Cost Of Minimum Wage: A Comprehensive Guide For Employers.

The Actual Cost Of Minimum Wage: A Comprehensive Guide For Employers

Understanding the actual cost of minimum wage is critical for employers to plan and manage their workforce effectively. Apart from the direct costs, there are indirect costs and hidden factors that impact the business finances and operations. This guide explores six essential aspects to consider for a comprehensive understanding of the true cost of minimum wage.

- Direct Wages: The most obvious cost is the wages paid to employees at minimum wage.

- Payroll Taxes: Employers are responsible for paying various taxes, such as Social Security and Medicare, based on the employee's wages, including minimum wage.

- Employee Benefits: Minimum wage workers are often eligible for benefits such as health insurance and paid time off, adding to the employer's costs.

- Training and Development: Employees may require additional training to meet minimum wage job requirements, incurring costs for the employer.

- Reduced Productivity: Employers may experience reduced productivity as higher wages can lead to increased absenteeism and turnover.

- Hidden Costs: Factors such as employee morale and customer satisfaction can be affected by minimum wage policies, impacting the overall business performance.

Sixth Circuit Clarifies FLSA’s Minimum Wage Requires Employers to - Source scopelitis.com

These aspects together present a comprehensive view of the actual cost of minimum wage, equipping employers to make informed decisions. By considering the direct, indirect, and hidden costs, employers can develop sustainable wage strategies that balance employee compensation with the overall financial health of their organization.

The Actual Cost Of Minimum Wage: A Comprehensive Guide For Employers

The actual cost of minimum wage goes beyond the hourly rate paid to employees. It encompasses a range of direct and indirect costs that affect businesses, including payroll taxes, employee benefits, and productivity. Employers must consider these costs when making decisions about wage levels and staffing.

The Comprehensive Guide To Salario Mínimo: Understanding Minimum Wage - Source topnewszones.pages.dev

Understanding the true cost of minimum wage is essential for accurate budgeting and financial planning. It helps businesses avoid unexpected expenses and mitigate the impact on profitability. Moreover, it enables informed decision-making regarding hiring strategies, employee retention, and overall labor costs.

To grasp the practical significance of this understanding, consider the example of a business employing 20 minimum wage workers. The hourly rate is $10, resulting in an annual wage expense of $400,000. However, the actual cost of these employees could be closer to $550,000, including payroll taxes and benefits.

By incorporating the actual cost of minimum wage into their calculations, businesses can make informed choices about staffing levels, employee compensation, and long-term financial sustainability.

| Cost Category | Description |

|---|---|

| Hourly Wage | The basic hourly rate paid to employees. |

| Payroll Taxes | Taxes withheld from employee paychecks, including Social Security, Medicare, and unemployment insurance. |

| Employee Benefits | Additional costs associated with employee compensation, such as health insurance, paid time off, and retirement contributions. |

| Overtime Pay | Additional wages paid to employees who work more than a specified number of hours per week. |

| Training and Development | Costs incurred to provide employees with the necessary skills and knowledge to perform their jobs effectively. |

Conclusion

The true cost of minimum wage extends beyond the hourly rate, encompassing various direct and indirect expenses. By factoring in these costs, businesses can make informed decisions about staffing levels, employee compensation, and long-term financial planning.

Understanding the actual cost of minimum wage is crucial for mitigating unexpected expenses and ensuring the sustainability of businesses. It allows employers to optimize their labor costs and allocate resources effectively, ultimately contributing to the overall success and profitability of their organizations.