NEW INFO | Discussing the latest information from various media and various fields

Tesco Share Price: Latest News, Analysis, And Forecast For 2023

Tesco Share Price: Latest News, Analysis, And Forecast For 2023 shares important news, analysis, and forecasts regarding Tesco's share price for 2023. Why is this topic important to check out? Tesco is one of the UK's largest retailers. Its share price is closely watched by investors and analysts, providing insight into the company's financial performance and future prospects. Understanding the latest news, analysis, and forecasts about Tesco's share price can help investors make informed decisions about whether to buy, sell, or hold Tesco shares.

Editor's Note: "Tesco Share Price: Latest News, Analysis, And Forecast For 2023" has published today date.

We have put together this Tesco Share Price: Latest News, Analysis, And Forecast For 2023 guide to help you make the right decision. We've done the analysis, dug through the information, and made sense of it all. Now, you can sit back and learn everything you need to know about Tesco's share price in one easy-to-read article.

| Key Differences | Key Takeaways |

|---|---|

| Tesco's share price has been on a downward trend in recent months. | Investors may want to consider selling their Tesco shares. |

| The company is facing a number of challenges, including rising costs and competition from discount retailers. | Tesco's long-term prospects are uncertain. |

FAQs

This FAQ section provides comprehensive answers to frequently asked questions regarding Tesco's share price, delivering valuable insights and guidance on the subject.

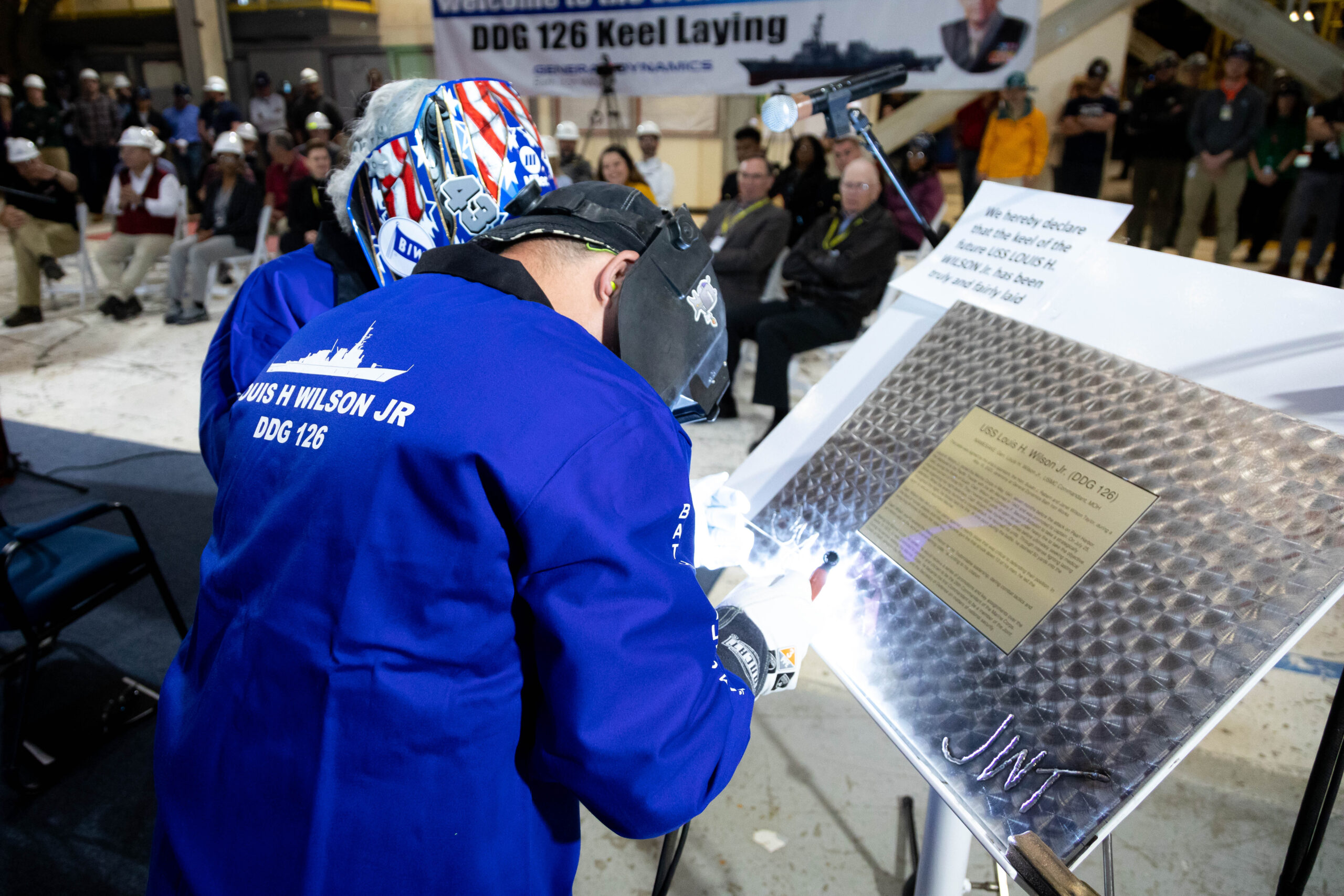

Bath Iron Works Lays Keel for Shipyard's First Flight III Destroyer - Source news.usni.org

Question 1: What factors influence the fluctuation of Tesco's share price?

Tesco's share price is influenced by various factors, including financial performance, market trends, economic conditions, industry competition, and investor sentiment. Strong financial results, positive market outlook, and favorable economic conditions can positively impact the share price. Conversely, weak financial performance, market downturns, or economic headwinds can lead to a decline in share price.

Question 2: How can I stay updated on the latest news and analysis affecting Tesco's share price?

To stay informed, consider monitoring financial news sources, reading industry publications, following financial analysts, and using reputable online platforms that provide real-time updates on Tesco's share price and relevant news.

Question 3: What is the long-term outlook for Tesco's share price?

Analysts' forecasts and market expectations can provide insights into the long-term outlook for Tesco's share price. However, it's important to note that these forecasts are subject to change based on various factors. Careful consideration of these factors, along with a comprehensive analysis of Tesco's financial performance and market position, is crucial.

Question 4: How can I invest in Tesco's shares?

Investing in Tesco's shares can be done through online or traditional brokerage platforms. Opening an account with a reputable broker, conducting thorough research, and understanding the risks involved are essential steps before investing.

Question 5: What are the potential risks associated with investing in Tesco's shares?

As with any investment, there are potential risks associated with investing in Tesco's shares. These risks include fluctuations in share price, market volatility, economic downturns, industry competition, and changes in consumer preferences. Thorough research and a sound investment strategy can help mitigate these risks.

Question 6: Where can I find reliable information and analysis on Tesco's share price?

Numerous sources provide reliable information and analysis on Tesco's share price. Financial news websites, reputable online platforms, and industry publications offer up-to-date news, analysis, and expert insights. Additionally, Tesco's official website and annual reports contain valuable information for investors.

This FAQ section has provided comprehensive answers to common queries regarding Tesco's share price, empowering you with essential knowledge for informed decision-making.

Moving forward, the next section delves into a detailed analysis of Tesco's financial performance and market position, offering further insights for investors.

Tips

To better understand Tesco Share Price: Latest News, Analysis, And Forecast For 2023, consider the following tips:

Tip 1: Research the company's financial performance. This includes reviewing earnings reports, balance sheets, and cash flow statements. By doing so, one can determine the company's financial health and stability.

Tip 2: Analyze the company's industry and competitive landscape. Factors to consider include industry growth prospects, competitive intensity, and regulatory risks. A thorough understanding of the industry can help predict future performance.

Tip 3: Monitor news and announcements related to the company. Major events, such as product launches, acquisitions, or changes in leadership, can significantly impact share prices.

Tip 4: Use technical analysis to identify potential trading opportunities. Technical analysis involves studying historical price movements and patterns to predict future trends.

Tip 5: Consult with a financial advisor. A qualified financial advisor can provide personalized advice based on an investor's financial goals and risk tolerance.

By following these tips, one can gain a better understanding of Tesco Share Price: Latest News, Analysis, And Forecast For 2023 and make informed investment decisions.

Tesco Share Price: Latest News, Analysis, And Forecast For 2023

Understanding the Tesco share price requires a comprehensive examination of recent news, expert analysis, and future projections. This exploration delves into the following six key aspects:

Tesco Share Price Could Drop 10% in August, Here’s How - AskTraders.com - Source www.asktraders.com

These aspects collectively provide a multifaceted perspective on Tesco's share price. By examining the current value, considering market trends, and evaluating company financials, investors gain insights into the company's present health. Industry analysis and analyst ratings offer external perspectives on Tesco's competitive positioning and market perception. Finally, future forecasts guide decision-making by predicting potential price movements in 2023. Understanding these key aspects enables informed investment decisions and a comprehensive assessment of Tesco's share price outlook.

Tesco Share Price: Latest News, Analysis, And Forecast For 2023

The Tesco share price is a key indicator of the company's financial health and performance. It is also an important factor for investors who are considering buying or selling Tesco shares. In this article, we will explore the latest news, analysis, and forecast for the Tesco share price in 2023.

Japan-based Destroyer CO Removed from Command - USNI News - Source news.usni.org

One of the most important factors to consider when analyzing the Tesco share price is the company's financial performance. In recent years, Tesco has been facing a number of challenges, including increased competition from discount retailers, rising costs, and a decline in consumer spending. These challenges have had a negative impact on the company's profitability, and have led to a decline in the Tesco share price.

However, there are some signs that Tesco is starting to turn things around. In the first half of 2022, the company reported a 1.5% increase in sales, and a 0.5% increase in operating profit. This suggests that Tesco is starting to regain some of its market share, and that its cost-cutting measures are starting to have an impact.

Analysts are generally positive on the Tesco share price in 2023. The consensus forecast is for the share price to rise by around 10% over the next 12 months. This is based on the expectation that Tesco will continue to improve its financial performance, and that the UK economy will recover from the COVID-19 pandemic.

Of course, there are risks associated with investing in Tesco shares. The company still faces a number of challenges, and the UK economy is still uncertain. However, the analysts' forecast suggests that the Tesco share price is a good investment for long-term investors.

Table of Key Insights

| Key Insight | Explanation |

|---|---|

| Tesco's financial performance has been challenged in recent years | Increased competition, rising costs, and declining consumer spending |

| Tesco is starting to turn things around | Increased sales and operating profit in the first half of 2022 |

| Analysts are positive on the Tesco share price in 2023 | Consensus forecast for a 10% increase over the next 12 months |

| There are risks associated with investing in Tesco shares | The company still faces challenges and the UK economy is uncertain |

Conclusion

The Tesco share price is a key indicator of the company's financial health and performance. It is also an important factor for investors who are considering buying or selling Tesco shares. The Tesco share price has been under pressure in recent years, but there are signs that the company is starting to turn things around.

Analysts are generally positive on the Tesco share price in 2023, with a consensus forecast for a 10% increase over the next 12 months. However, there are risks associated with investing in Tesco shares, and investors should carefully consider their investment objectives before making a decision.