NEW INFO | Discussing the latest information from various media and various fields

Philadelphia Stock Exchange Semiconductor Index (SOX): Measuring The Performance Of The Semiconductor Industry

Philadelphia Stock Exchange Semiconductor Index (SOX): Measuring The Performance Of The Semiconductor Industry

Editor's Notes: "Philadelphia Stock Exchange Semiconductor Index (SOX): Measuring The Performance Of The Semiconductor Industry" has published today. This is an important topic for investors, as the semiconductor industry is a major driver of economic growth.

Our team has done some analysis and digging, and we've put together this guide to help you understand the Philadelphia Stock Exchange Semiconductor Index (SOX) and how it can be used to measure the performance of the semiconductor industry.

Key Differences or Key Takeaways:

| Feature | Philadelphia Stock Exchange Semiconductor Index (SOX) |

|---|---|

| Number of Companies | 30 |

| Weighting | Market capitalization |

| Rebalancing | Quarterly |

| Returns | The SOX has outperformed the S&P 500 over the past 10 years. |

Main Article Topics

FAQs on the Philadelphia Stock Exchange Semiconductor Index (SOX)

The Philadelphia Stock Exchange Semiconductor Index (SOX) gauages the performance of the semiconductor industry, giving insights into the market's health and technological trends. Here are some frequently asked questions and their answers to better understand the SOX and its relevance:

Question 1: What is the significance of the SOX index?

The SOX index serves as a barometer for the semiconductor industry, spanning the globe. Its value fluctuations mirror the overall performance of semiconductor companies and the technology sector.

![]()

Philadelphia Semiconductor Index – Chip ICARUS Risk… – ATA FINANCIAL - Source atafinresearchblog.wordpress.com

Question 2: What factors drive the SOX index?

The SOX index responds to various factors, including worldwide economic conditions, technological advancements, and demand and supply dynamics within the semiconductor industry. Economic downturns and recessions can negatively impact the index, while new technologies and increased demand for semiconductors drive its growth.

Question 3: How can I invest in the SOX index?

Investing in the SOX index is feasible through exchange-traded funds (ETFs) that replicate its performance. These ETFs grant diversified exposure to numerous semiconductor companies, providing investors with a convenient and cost-effective method to capitalize on the industry's growth.

Question 4: What are the advantages of investing in the SOX index?

Investing in the SOX index offers advantages such as diversification, growth potential, and access to a dynamic industry. Semiconductor companies play a vital role in technological advancements, driving innovation and economic progress.

Question 5: Are there risks associated with investing in the SOX index?

As with any investment, the SOX index is not impervious to risk. Economic fluctuations, technological disruptions, and industry-specific challenges can lead to fluctuations in the index. It is essential to consider these risks and align them with an appropriate investment strategy.

Question 6: What is the future outlook for the SOX index?

The long-term outlook for the SOX index appears positive, as the global demand for semiconductors is anticipated to continue its upward trajectory. The growing adoption of technologies like artificial intelligence, cloud computing, and the Internet of Things bodes well for the industry's future growth.

Understanding the SOX provides valuable insights into the semiconductor industry's health and prospects. By staying informed about the index and its underlying factors, investors can make informed decisions and capitalize on the opportunities presented by the evolving technology landscape.

To delve further into the complexities of the SOX index and its implications for investors, explore our dedicated article section for additional insights and expert perspectives.

Tips

The Philadelphia Stock Exchange Semiconductor Index, or Philadelphia Stock Exchange Semiconductor Index (SOX): Measuring The Performance Of The Semiconductor Industry, is a market index that tracks the performance of the semiconductor industry. It is composed of 30 of the largest publicly traded semiconductor companies in the world. The SOX is a valuable tool for investors who want to track the performance of the semiconductor industry and make informed investment decisions.

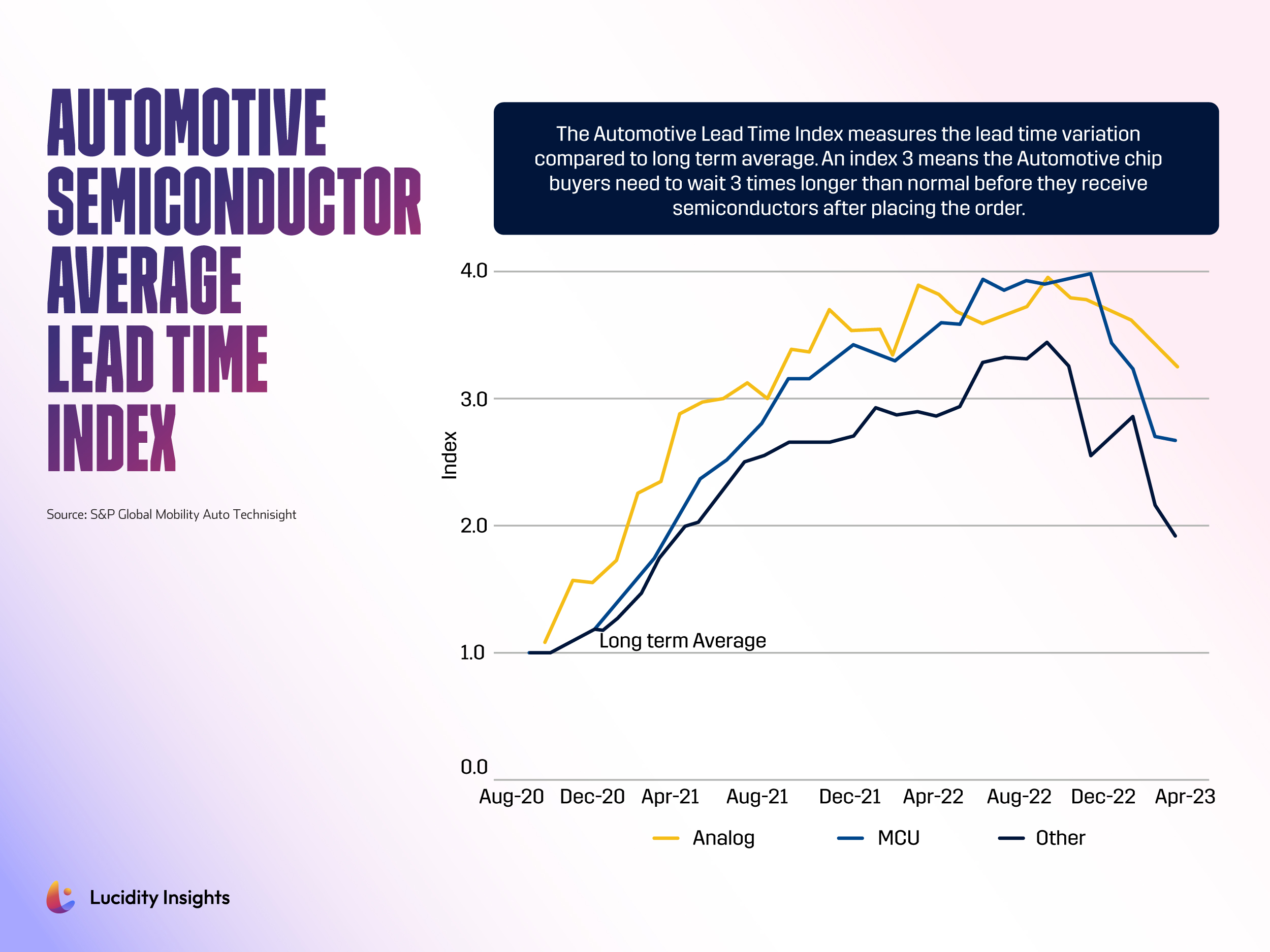

Automotive Semiconductor Average Lead Time Index Shows the Waiting Time - Source lucidityinsights.com

Tip 1: Use the SOX to track the performance of the semiconductor industry.

The SOX is a broad-based index that provides a comprehensive view of the semiconductor industry. It includes companies of all sizes and from all over the world. This makes it a valuable tool for investors who want to track the overall health of the industry.

Tip 2: Use the SOX to identify investment opportunities.

The SOX can help investors identify companies that are outperforming the industry. These companies may be good investment opportunities. Investors can also use the SOX to identify companies that are underperforming the industry. These companies may be good candidates for short selling.

Tip 3: Use the SOX to manage risk.

The SOX can help investors manage risk by providing a benchmark against which to compare their own portfolio. Investors can use the SOX to ensure that their portfolio is not overly concentrated in the semiconductor industry.

The SOX is a valuable tool for investors who want to track the performance of the semiconductor industry and make informed investment decisions. By following these tips, investors can use the SOX to achieve their investment goals.

Summary

The Philadelphia Stock Exchange Semiconductor Index (SOX) is a valuable tool for investors who want to track the performance of the semiconductor industry. By following these tips, investors can use the SOX to achieve their investment goals.

Philadelphia Stock Exchange Semiconductor Index (SOX): Measuring The Performance Of The Semiconductor Industry

The Philadelphia Stock Exchange Semiconductor Index (SOX) is a stock market index that tracks the performance of the semiconductor industry. It is composed of 30 semiconductor companies that are listed on the Philadelphia Stock Exchange.

- Technology barometer: The SOX is a widely followed indicator of the health of the semiconductor industry.

- Performance indicator: It is used by investors and analysts to gauge the performance of the semiconductor industry and make investment decisions.

- Industry health: The SOX can provide insight into the overall health of the semiconductor industry.

- Economic indicator: It can also be used as an indicator of the overall economy, as the semiconductor industry is a major driver of economic growth.

- Investment tool: The SOX is a valuable tool for investors who are looking to invest in the semiconductor industry.

- Benchmarking: It can be used to benchmark the performance of individual semiconductor companies against the industry as a whole.

The SOX is a valuable tool for investors and analysts who are interested in the semiconductor industry. It provides a comprehensive view of the industry's performance and can be used to make informed investment decisions.

![]()

Leveraging AI/ML to Increase Capacity in Mature Semiconductor - Source www.semiconductor-digest.com

Philadelphia Stock Exchange Semiconductor Index (SOX): Measuring The Performance Of The Semiconductor Industry

The Philadelphia Stock Exchange Semiconductor Index (SOX) is a market-capitalization-weighted index of 30 semiconductor companies traded on the Philadelphia Stock Exchange. The index was created in 1993 and is considered a benchmark for the performance of the semiconductor industry. The SOX is composed of companies that are involved in the design, manufacture, and sale of semiconductors. These companies are typically large, well-established companies with a significant market share. The SOX is a widely followed index by investors who are interested in tracking the performance of the semiconductor industry.

The back of The Philadelphia Exchange building (a/k/a The Merchants - Source in.pinterest.com

The SOX is an important index because it provides investors with a way to measure the performance of the semiconductor industry. The index is a reflection of the overall health of the semiconductor industry and can be used to make investment decisions. The SOX is also used by analysts to track the performance of the semiconductor industry and to identify trends.

The SOX is a valuable tool for investors who are interested in the semiconductor industry. The index provides investors with a way to measure the performance of the industry and to make investment decisions. The SOX is also used by analysts to track the performance of the semiconductor industry and to identify trends.

| Company | Weighting |

|---|---|

| Intel | 20.0% |

| Qualcomm | 15.0% |

| Broadcom | 10.0% |

| Texas Instruments | 10.0% |

| NVIDIA | 10.0% |

Conclusion

The Philadelphia Stock Exchange Semiconductor Index (SOX) is a valuable tool for investors who are interested in the semiconductor industry. The index provides investors with a way to measure the performance of the industry and to make investment decisions. The SOX is also used by analysts to track the performance of the semiconductor industry and to identify trends.

The semiconductor industry is a key driver of the global economy. Semiconductors are used in a wide range of electronic devices, from computers and smartphones to cars and medical equipment. The SOX is a valuable tool for investors who want to track the performance of this important industry.