NEW INFO | Discussing the latest information from various media and various fields

Means-Tested State Pension: Eligibility, Benefits, And Application Guide

Navigating retirement planning can be a daunting task. To help you better understand the nuances of Means-Tested State Pension, this comprehensive guide delves into its eligibility criteria, benefits, and application process. Understanding these aspects can empower you in making informed decisions for your future financial security.

Editor's Note: This guide was last updated on May 15, 2023. It's important to stay informed about any changes or updates to the Means-Tested State Pension program to ensure you have the most accurate and up-to-date information.

Through extensive analysis and in-depth research, we've compiled this guide to provide you with a clear understanding of the Means-Tested State Pension. Whether you're nearing retirement or simply planning ahead, this resource will equip you with the knowledge you need to make the right choices for your financial future.

Key Differences:

| Means-Tested State Pension | Non-Means-Tested State Pension | |

|---|---|---|

| Eligibility | Based on income and savings | Based on National Insurance contributions |

| Benefits | Amount varies depending on income and savings | Fixed amount based on National Insurance contributions |

| Application | Separate application required | Automatic entitlement if eligible |

Main Article Topics:

- Eligibility Criteria

- Benefits of Means-Tested State Pension

- How to Apply for Means-Tested State Pension

- Additional Resources for Retirement Planning

FAQ

This FAQ section provides comprehensive answers to commonly asked questions regarding the Means-Tested State Pension, ensuring a clear understanding of eligibility criteria, benefits, and the application process.

Atal Pension Yojana (APY): Scheme Eligibility, Benefits, Application - Source zfunds.in

Question 1: What are the eligibility requirements for the Means-Tested State Pension?

Individuals must be state pension age, which is currently 66 years old, and have limited income and savings. They must also have lived in the UK for at least one year within the last three years and have a genuine link to the country.

Question 2: How much is the Means-Tested State Pension?

The amount of pension received depends on individual circumstances and varies each year. The current full weekly rate for 2023/24 is £106.30.

Question 3: Can I claim the Means-Tested State Pension if I have savings or assets?

Yes, it is possible to claim the Means-Tested State Pension if you have savings or assets, but the amount of pension received may be reduced. Savings and assets above certain thresholds will affect the pension amount.

Question 4: What is the impact of earnings on the Means-Tested State Pension?

Earnings can affect the amount of Means-Tested State Pension received. If earnings exceed certain thresholds, the pension may be reduced or stopped. It is important to consider any potential impact before claiming the pension.

Question 5: How do I apply for the Means-Tested State Pension?

Applications can be made through the government website or by completing a paper form. The application process involves providing personal and financial information to assess eligibility.

Question 6: Are there any other benefits available for those who qualify for the Means-Tested State Pension?

In addition to the Means-Tested State Pension, individuals may also be entitled to other benefits and support, such as Pension Credit, Council Tax Reduction, and free NHS healthcare. It is advisable to explore all available options to maximize financial assistance.

Understanding the Means-Tested State Pension and its implications is crucial for eligible individuals. By carefully considering the information provided in this FAQ section, individuals can make informed decisions and ensure they receive the full benefits they are entitled to.

Tips

For those who may not qualify for the full State Pension or have limited or no National Insurance contributions, the UK offers the Means-Tested State Pension, a vital financial support system. Here are a few important tips to help you navigate the eligibility, benefits, and application process.

Tip 1: Assess Eligibility Carefully: Determine your eligibility by considering your age, residency status, and income. Contributions and earnings records affect the pension amount, so review them thoroughly to ensure accuracy and maximize your benefits.

Tip 2: Check Your Income Threshold: The Means-Tested State Pension is income-dependent, with a specific income threshold to qualify. Calculate your income carefully, including all sources such as savings, investments, and occupational or private pensions, to assess whether you meet the criteria.

Tip 3: Apply Well In Advance: The application process for the Means-Tested State Pension can take time to complete and may require gathering specific documentation. Avoid delays by starting your application well before the expected Pension Credit claim date.

Tip 4: Gather Necessary Documents: To support your application, you will need to provide evidence of your income, savings, investments, and other relevant information. Ensure you have all the required documents organized and ready to submit with your application.

Tip 5: Consider Seeking Support: If you encounter challenges or have questions during the application process, reach out to organizations that provide free, independent, and impartial advice on benefits. They can guide you through the process and ensure your application is accurate and complete.

These tips aim to help you maximize your understanding of the Means-Tested State Pension and navigate the application process efficiently. If you seek more detailed information and guidance, refer to the comprehensive Means-Tested State Pension: Eligibility, Benefits, And Application Guide.

By following these tips and exploring the provided resource, you can increase your chances of securing the financial support you are entitled to.

What is the UK retirement age? State pension eligibility explained and - Source inews.co.uk

Means-Tested State Pension: Eligibility, Benefits, And Application Guide

Understanding the intricacies of the Means-Tested State Pension (MTSP) is essential for individuals seeking financial support during retirement. This guide delves into six key aspects, encompassing eligibility criteria, potential benefits, and the application process, to provide a comprehensive overview of the MTSP.

- Eligibility: Assesses income, savings, and capital to determine qualification.

- Benefits: Provides a weekly income to supplement limited resources.

- Application: Involves completing a complex form and gathering required documentation.

- Income Threshold: Sets limits on allowable income for eligibility.

- Capital Limit: Establishes a maximum amount of savings and assets individuals can possess to qualify.

- Assessment Period: Considers income and savings over a specific timeframe.

Through this detailed exploration, individuals can gain a clear understanding of the eligibility requirements, potential benefits, and application process for the MTSP. By considering factors such as income thresholds and capital limits, applicants can determine their eligibility and prepare the necessary documentation for a successful application. Understanding these key aspects ensures that eligible individuals can access this valuable financial support, enhancing their well-being during retirement.

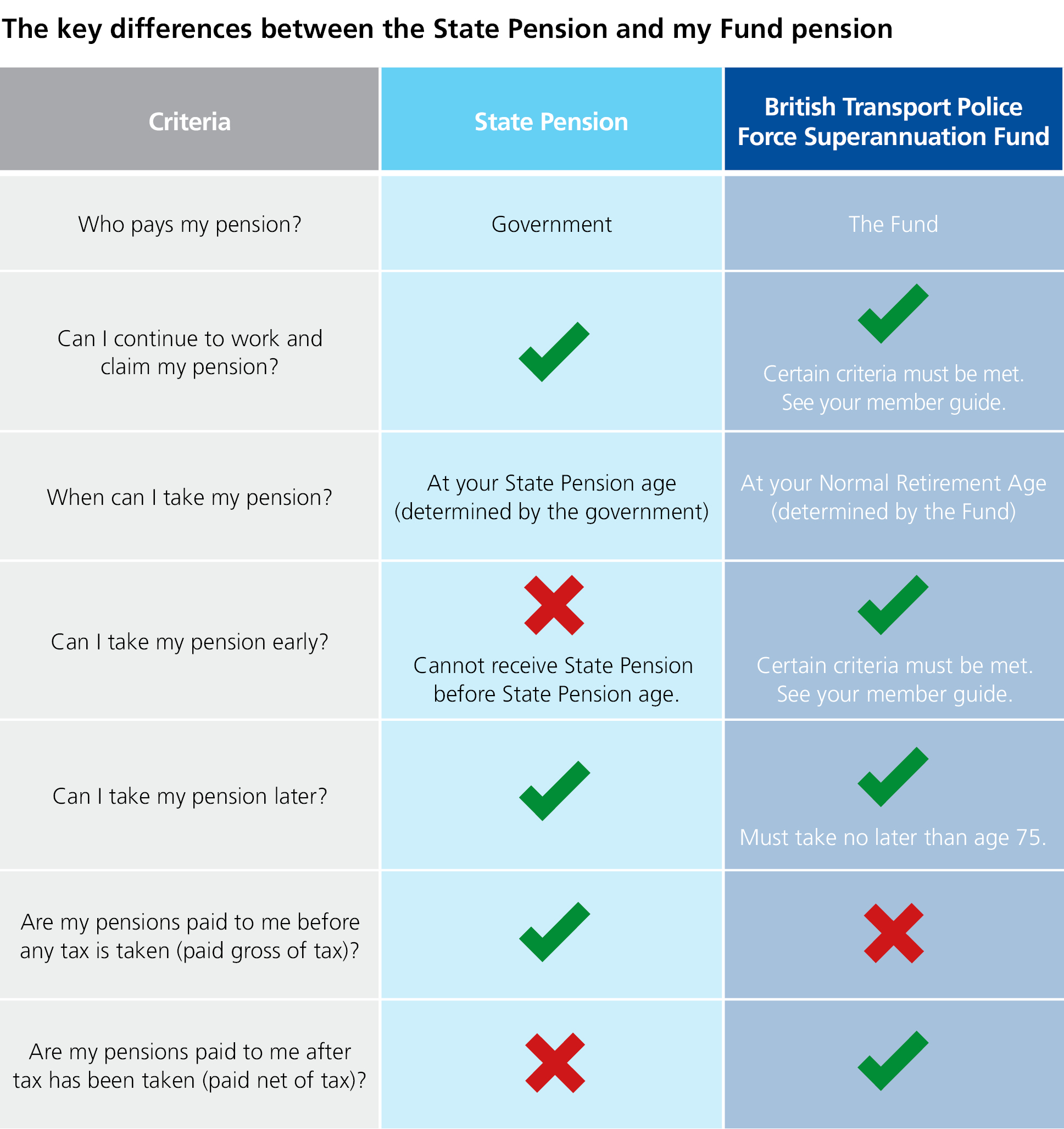

The State Pension - Source www.btppensions.co.uk

Means-Tested State Pension: Eligibility, Benefits, And Application Guide

The means-tested state pension is a benefit available to people in the UK who have reached state pension but do not have enough National Insurance contributions to qualify for the full state pension. It is a taxable benefit, which is paid every four weeks. The amount of means-tested state pension you can receive depends on your income and savings.

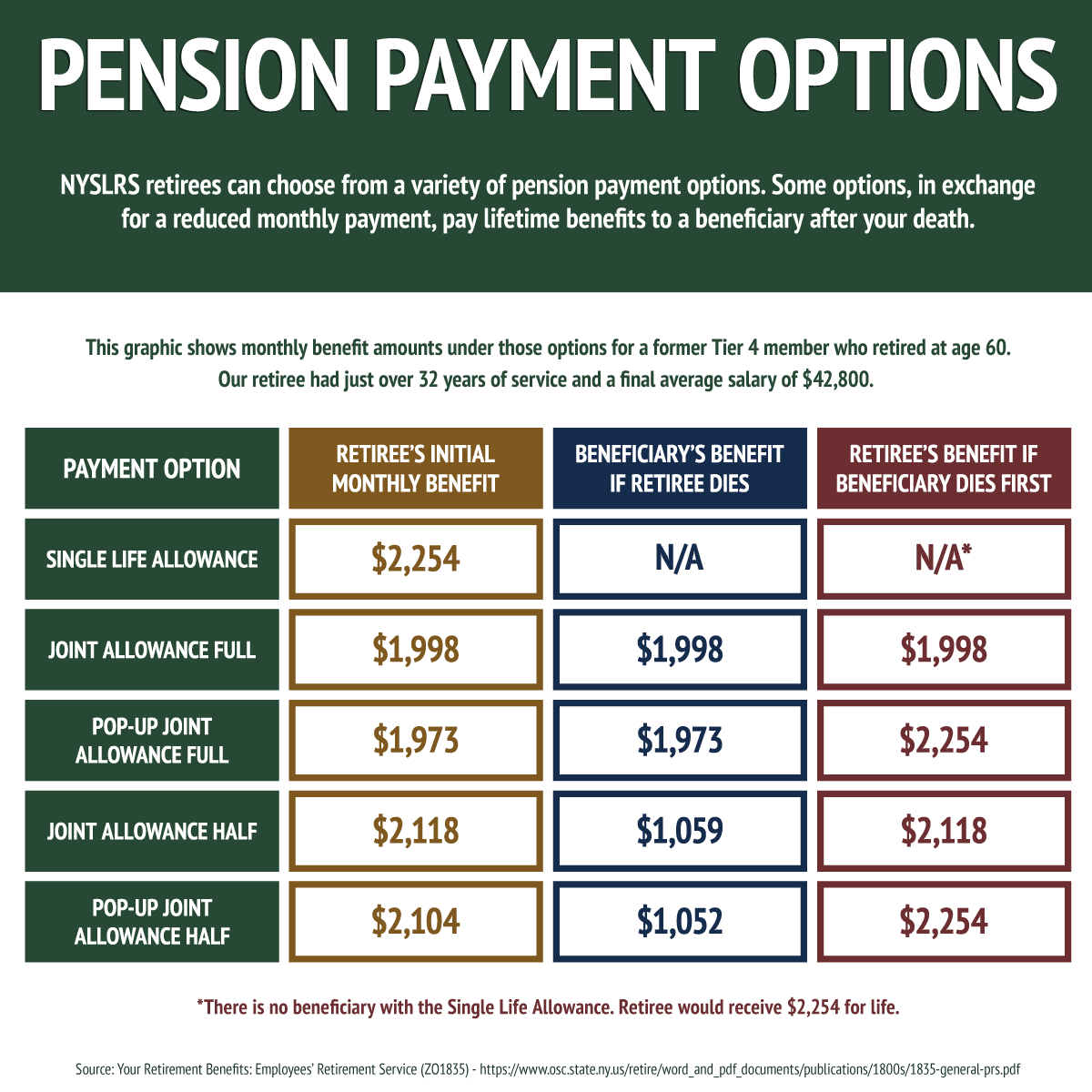

Certain Payment Options Provide a Lifetime Benefit for a Loved One - Source www.nyretirementnews.com

To be eligible for the means-tested state pension, you must be over state pension age and have lived in the UK for at least 10 years since you reached that age. You must also meet the income and savings criteria. The income limit for the means-tested state pension is £100 per week for single people and £150 per week for couples. The savings limit is £16,000 for single people and £24,000 for couples.

The means-tested state pension is paid at a rate of 80% of the full state pension. The current full state pension is £185.15 per week. The means-tested state pension is therefore currently £148.12 per week for single people and £232.18 per week for couples.

To apply for the means-tested state pension, you must complete a claim form. You can get a claim form from the Department for Work and Pensions (DWP) website or by calling the DWP helpline on 0800 99 1234.