NEW INFO | Discussing the latest information from various media and various fields

Dow Jones Industrial Average: Historic Milestones And Market Trends

Dow Jones Industrial Average: Historic Milestones And Market Trends is a widely recognized index that has stood the test of time.

Editor's Notes: Dow Jones Industrial Average: Historic Milestones And Market Trends have published today is a great opportunity to know and learn about Historic Milestones And Market Trends for taking right decision.

Our team has analyzed, dug into the information, and put together this guide to help you make the right decision.

FAQ

This FAQ section provides concise answers to frequently asked questions about the Dow Jones Industrial Average, offering a deeper understanding of its historic milestones and market trends.

Question 1: What is the significance of the Dow Jones Industrial Average (DJIA)?

Answer: The DJIA is a stock market index that tracks the 30 largest industrial companies listed on the New York Stock Exchange and the NASDAQ. It is considered a barometer of the overall U.S. stock market, reflecting the performance of these blue-chip companies.

The rise of the Dow Jones Industrial Average from 1895 - 2015 - Source br.pinterest.com

Question 2: How and when did the DJIA originate?

Answer: Created by Charles Dow and Edward Jones in May 1896, the DJIA initially tracked 12 major industrial companies. Over time, the index has undergone several revisions, adding and replacing companies to reflect the evolving U.S. economy.

Question 3: What are some of the most notable milestones in the DJIA's history?

Answer: Significant milestones include the first 100-point day in 1929, reaching 10,000 in 1972, 20,000 in 1995, and 30,000 in 2020. These milestones underscore the long-term growth and resilience of the U.S. stock market.

Question 4: How does the DJIA differ from other stock market indices?

Answer: Unlike capitalization-weighted indices like the S&P 500, the DJIA uses a price-weighted approach. This means that stocks with higher share prices have a more significant impact on the index's movement.

Question 5: What factors influence the DJIA's performance?

Answer: The DJIA is influenced by various factors, including economic conditions, earnings reports, interest rates, global events, and investor sentiment. Strong economic growth, positive corporate earnings, and low interest rates typically contribute to a rising DJIA.

Question 6: How can investors use the DJIA to make informed decisions?

Answer: The DJIA provides insights into the overall health of the stock market. Investors can monitor its performance to gauge market sentiment, identify trends, and make informed trading decisions. However, it's important to consider the DJIA in conjunction with other market indicators to gain a comprehensive perspective.

In conclusion, the Dow Jones Industrial Average remains an iconic stock market index, providing valuable insights into the performance of the U.S. economy and stock market. Understanding its historic milestones and market trends is essential for investors seeking to make informed decisions.

Proceed to the next section for a comprehensive overview of the Dow Jones Industrial Average.

Tips

Discover insightful tips to navigate the complexities of Dow Jones Industrial Average: Historic Milestones And Market Trends and make informed decisions in the financial markets.

Tip 1: Understand the Index's Composition

The Dow Jones Industrial Average comprises 30 of the largest and most influential companies in the United States, providing a snapshot of the overall health of the U.S. stock market.

Tip 2: Track Long-Term Trends

The Dow Jones Industrial Average has a long history dating back to 1896, making it an invaluable resource for understanding market behavior over time. Studying its historical trends can help identify long-term patterns and seasonal fluctuations.

Tip 3: Monitor Economic Factors

The Dow Jones Industrial Average is influenced by a wide range of economic factors, including interest rates, inflation, and GDP growth. Staying abreast of these factors can provide context for the index's movements and help anticipate future performance.

Tip 4: Use Technical Analysis

Technical analysis involves studying price charts and historical data to identify patterns and trends that could indicate future price movements. Traders often use this information to make decisions about entering or exiting positions.

Tip 5: Consider Sector Composition

The Dow Jones Industrial Average includes companies from various sectors, such as technology, finance, and healthcare. Understanding the sector composition of the index can help assess its vulnerability to specific economic events or industry-specific trends.

Summary: By understanding the composition, tracking long-term trends, monitoring economic factors, using technical analysis, and considering sector composition, investors can gain valuable insights into the Dow Jones Industrial Average: Historic Milestones And Market Trends and make informed investment decisions.

Dow Jones Industrial Average: Historic Milestones And Market Trends

The Dow Jones Industrial Average (DJIA) is one of the world's most followed stock market indices, providing valuable insights into the overall performance of the U.S. economy and serving as a benchmark for investment decisions.

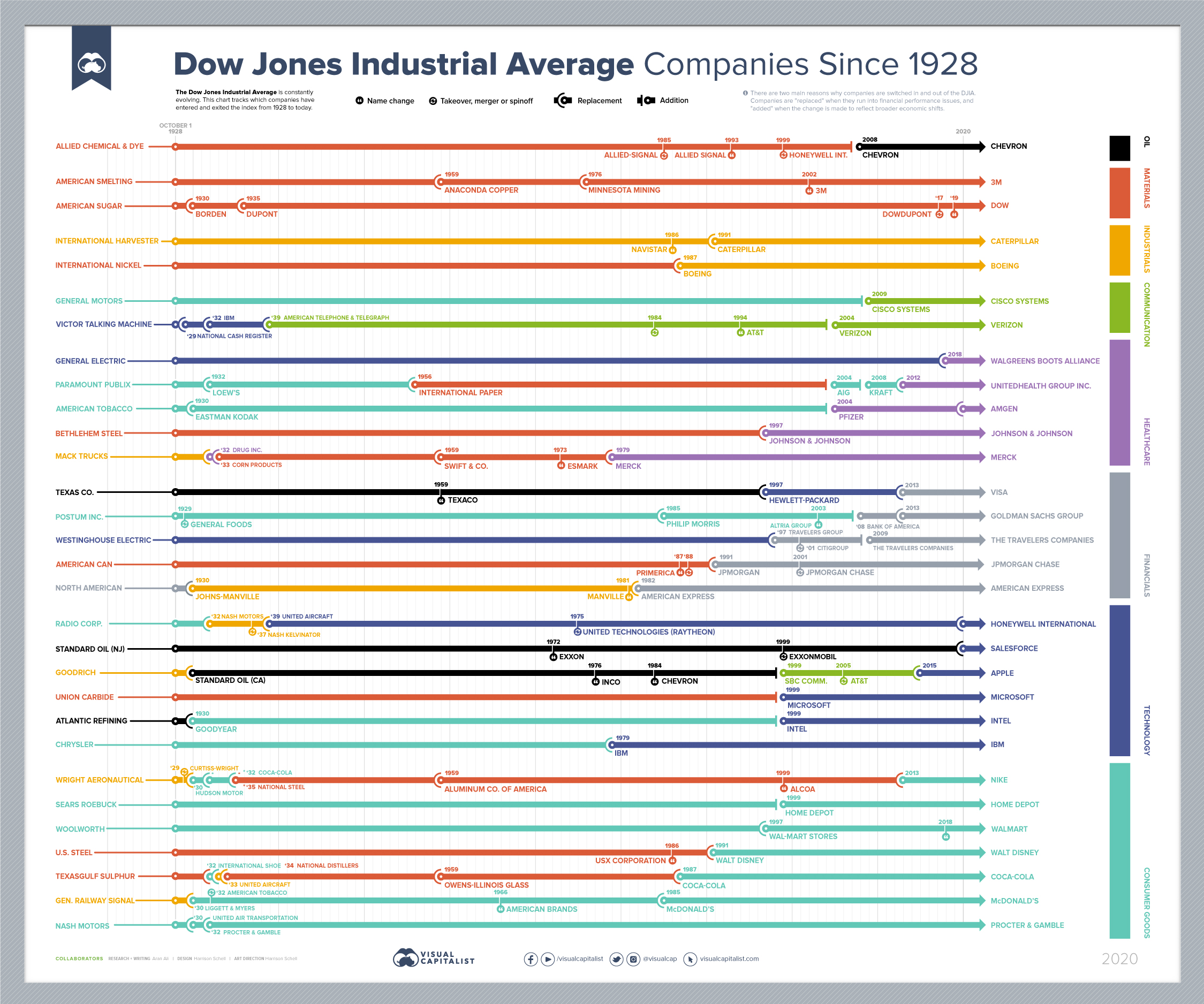

Every Company In and Out of the Dow Jones Industrial Average Since 1928 - Source www.visualcapitalist.com

- Inception and Evolution: Established in 1896 with 12 companies, the DJIA has grown to 30 blue-chip companies, reflecting the transformation of the American economy.

- Market Indicator: As a price-weighted index, the DJIA gauges the performance of its constituent companies, reflecting market sentiment and economic health.

- Historical Milestones: Key milestones include crossing 1,000 in 1972, 10,000 in 1999, and 20,000 in 2017, marking significant periods of economic growth.

- Bull and Bear Markets: The DJIA's fluctuations have defined bull (rising) and bear (declining) markets, shaping investor strategies and market confidence.

- Global Impact: Being a bellwether for the U.S. economy, the DJIA influences global markets and investor sentiment.

- Economic Indicator: Movements in the DJIA correlate with economic indicators, making it a barometer for economic health and business prospects.

These aspects highlight the DJIA's historical significance, its role as a market indicator, and its influence on investor sentiment and global markets. Its milestones represent periods of economic expansion or downturns, and its trends provide insights into the overall health of the U.S. economy.

Calculating and Interpreting Dow Jones Dividend Yield | Cubicle No More - Source cubiclenomore.com

Dow Jones Industrial Average: Historic Milestones And Market Trends

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks the performance of 30 of the largest publicly traded companies in the United States. It is one of the most widely followed stock market indices in the world and is often used as a barometer of the overall health of the U.S. economy.

Dow Jones 1929 To 1939 Chart - The Stock Market Crash Of 1929 What You - Source gregorfrazier.blogspot.com

The DJIA was created in 1896 by Charles Dow and Edward Jones, who were the founders of the Dow Jones & Company. The index initially included 12 companies, but over time it has been expanded to include 30 companies. The DJIA is calculated by taking the sum of the stock prices of the 30 companies and dividing by a divisor that is adjusted to ensure that the index remains relatively stable over time.

The DJIA has a long history of ups and downs, reflecting the overall performance of the U.S. economy. The index reached its all-time high of 36,799.65 on January 4, 2022, and its all-time low of 65.45 on August 2, 1932. The DJIA has also experienced several major crashes, including the Great Crash of 1929 and the Black Monday crash of 1987.

The DJIA is a valuable tool for investors and analysts to track the performance of the U.S. economy. The index can be used to identify trends in the stock market and to make investment decisions.

Here is a table of some of the key milestones in the history of the Dow Jones Industrial Average:

| Date | Milestone |

|---|---|

| 1896 | The Dow Jones Industrial Average is created. |

| 1929 | The Great Crash of 1929 causes the DJIA to plunge by nearly 50%. |

| 1932 | The DJIA reaches its all-time low of 65.45. |

| 1987 | The Black Monday crash of 1987 causes the DJIA to drop by over 20%. |

| 2008 | The Great Recession causes the DJIA to fall by over 50%. |

| 2022 | The DJIA reaches its all-time high of 36,799.65. |

Conclusion

The Dow Jones Industrial Average is a valuable tool for investors and analysts to track the performance of the U.S. economy. The index has a long history of ups and downs, but it has always rebounded from setbacks. The DJIA is a reminder that the U.S. economy is resilient and that over the long term, the stock market has always trended upwards.

The DJIA is also a symbol of the U.S.'s economic power. It is the most followed stock market index in the world and is often used as a barometer of global economic health. The DJIA is a reminder that the U.S. is the world's largest economy and that it plays a vital role in the global economy.