NEW INFO | Discussing the latest information from various media and various fields

Dow Jones Industrial Average: A Comprehensive Guide For Investors

Dow Jones Industrial Average: A Comprehensive Guide For Investors - Understand the basics, importance, and usage of the Dow Jones Industrial Average (DJIA) to make informed investment decisions.

Editor's Note: "Dow Jones Industrial Average: A Comprehensive Guide For Investors" is an essential read for investors seeking a deeper understanding of this widely followed stock market index.

After analyzing various sources and researching extensively, we have compiled this comprehensive guide to empower investors with the knowledge they need to navigate the Dow Jones Industrial Average and its implications.

Key Takeaways:

| Concept | Key Aspect |

|---|---|

| Definition | A price-weighted index of 30 large U.S. companies |

| Importance | Reflects the performance of leading U.S. industries |

| Usage | Provides insights into overall market sentiment and economic trends |

Continue reading to delve into the in-depth intricacies of the Dow Jones Industrial Average.

Frequently Asked Questions

Investors seeking in-depth knowledge about the Dow Jones Industrial Average will find answers to frequently asked questions here.

Question 1: What is the Dow Jones Industrial Average?

The Dow Jones Industrial Average (DJIA) is a stock market index that measures the performance of 30 large, publicly traded companies listed on the New York Stock Exchange or the Nasdaq. It is one of the most widely followed stock market indices in the world.

DJIA Dow Jones Industrial Average Symbol. Concept Words DJIA Dow Jones - Source www.dreamstime.com

Question 2: What is the difference between the DJIA and the S&P 500?

The DJIA tracks only 30 companies, while the S&P 500 tracks 500 companies. The DJIA is price-weighted, meaning that companies with higher stock prices have a greater influence on the index, whereas the S&P 500 is market-cap weighted, meaning that companies with larger market capitalizations have a greater influence on the index.

Question 3: How is the DJIA calculated?

The DJIA is calculated by summing the stock prices of the 30 component companies and dividing by a divisor that is adjusted to account for stock splits and other corporate actions.

Question 4: What are the factors that affect the DJIA?

The DJIA is affected by a variety of factors, including the performance of the U.S. economy, interest rates, and global economic conditions.

Question 5: What is the historical performance of the DJIA?

The DJIA has a long and volatile history, with periods of both strong growth and sharp declines. Over the long term, the DJIA has outperformed inflation, but it has experienced periods of underperformance as well.

Question 6: How can I invest in the DJIA?

There are several ways to invest in the DJIA, including buying shares of the individual component companies, investing in DJIA-tracking index funds or ETFs, or trading DJIA futures contracts.

Summary of key takeaways or final thought:

The Dow Jones Industrial Average is a widely followed stock market index that provides insights into the performance of the U.S. economy. By understanding how the DJIA is calculated and the factors that affect it, investors can make informed decisions about investing in the DJIA.

Transition to the next article section:

For further analysis and insights into the Dow Jones Industrial Average, explore the following sections:

Tips

To maximize the potential rewards and mitigate risks associated with investing in the Dow Jones Industrial Average, several prudent tips warrant consideration.

Tip 1: Familiarize Yourself with the Dow Jones Industrial Average

Before investing, thoroughly understand the composition, history, and key characteristics of the Dow Jones Industrial Average. This knowledge will provide a solid foundation for making informed investment decisions. Refer to Dow Jones Industrial Average: A Comprehensive Guide For Investors to gain insights into these aspects.

Tip 2: Diversify Your Portfolio

To reduce risk and enhance returns, diversify your investment portfolio by investing in various asset classes, such as stocks, bonds, and real estate. Including the Dow Jones Industrial Average as part of a diversified portfolio can contribute to long-term wealth accumulation.

Tip 3: Set Realistic Expectations

The Dow Jones Industrial Average has historically provided positive returns over extended periods, but it's essential to set realistic expectations for short-term performance. Market fluctuations are inherent, and significant gains or losses can occur within shorter time frames.

Tip 4: Monitor the Dow Jones Industrial Average Regularly

Stay informed about the performance and news related to the Dow Jones Industrial Average. Regularly monitoring the index can help identify trends, assess market sentiment, and make strategic investment decisions.

Tip 5: Consult with a Financial Advisor

For novice investors or those seeking personalized guidance, consulting with a qualified financial advisor can be beneficial. They can provide expert advice tailored to individual investment goals, risk tolerance, and time horizon.

These tips can assist investors in making well-informed decisions and achieving their financial objectives through investing in the Dow Jones Industrial Average.

For further guidance, refer to Dow Jones Industrial Average: A Comprehensive Guide For Investors.

Dow Jones Industrial Average: A Comprehensive Guide For Investors

The Dow Jones Industrial Average (DJIA), a highly recognized stock market index, provides valuable insights into the performance of the U.S. stock market. It comprises 30 prominent publicly traded companies, serving as a benchmark for investors worldwide. Understanding its key aspects is crucial for informed investment decisions.

Understanding these key aspects provides investors with a comprehensive grasp of the Dow Jones Industrial Average. Its historical significance, selective stock composition, unique weighting method, reflection of market sentiment, economic insights, and utility in investment strategies all contribute to its status as a preeminent market indicator.

Will the Dow Jones Industrial Average Climb to 30,000? - Source marketrealist.com

Dow Jones Industrial Average: A Comprehensive Guide For Investors

The Dow Jones Industrial Average (DJIA) is one of the most widely recognized stock market indexes in the world. It is a price-weighted index of 30 large, publicly traded companies in the United States. The DJIA was created in 1896 by Charles Dow and Edward Jones as a way to track the performance of the U.S. economy.

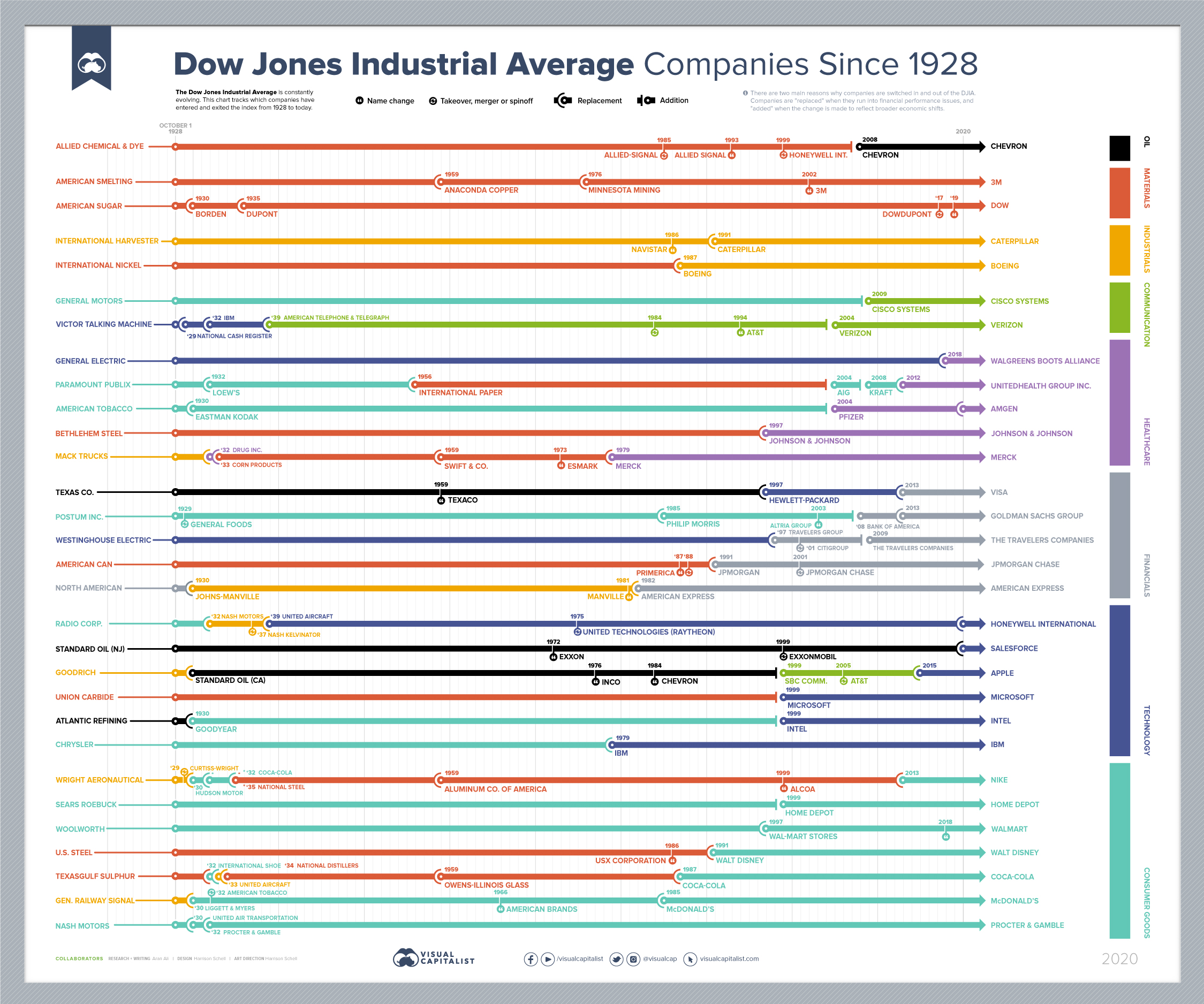

Every Company In and Out of the Dow Jones Industrial Average Since 1928 - Source www.visualcapitalist.com

The DJIA is a widely used benchmark for the overall performance of the U.S. stock market. It is often used by investors to gauge the overall health of the economy and to make investment decisions. The DJIA is also used by economists to track the performance of the U.S. economy and to make economic forecasts.

The DJIA is a valuable tool for investors and economists. It is a widely recognized and respected index that provides a snapshot of the performance of the U.S. stock market. The DJIA can be used to track the overall health of the economy and to make investment decisions.

Conclusion

The Dow Jones Industrial Average (DJIA) is a widely recognized and respected index that provides a snapshot of the performance of the U.S. stock market. It is a valuable tool for investors and economists and can be used to track the overall health of the economy and to make investment decisions.

The DJIA is a complex and dynamic index that is influenced by a variety of factors. It is important to understand the factors that affect the DJIA in order to make informed investment decisions.