NEW INFO | Discussing the latest information from various media and various fields

Child Allowance 2023: Comprehensive Guide For Eligibility, Benefits, And Application

Seeking a deep understanding of the "Child Allowance 2023: Comprehensive Guide for Eligibility, Benefits, and Application"? We have covered you!

Editor's Notes: "Child Allowance 2023: Comprehensive Guide for Eligibility, Benefits, and Application" has been published today, March 8, 2023. This guide is essential reading for anyone potentially eligible for this valuable tax break.

To provide our readers with the most up-to-date and comprehensive information, we have meticulously analyzed and gathered data to create this comprehensive guide.

Key Differences

| Child Tax Credit (CTC) | Child and Dependent Care Tax Credit (CDCTC) | |

|---|---|---|

| Eligibility | Dependent child under 17 | Dependent child under 13 or disabled spouse or dependent |

| Amount | Up to $2,000 per child | Up to $3,000 per child (or $6,000 for two or more children) |

| Refundability | Yes | No |

Transition to main article topics

FAQ

This section provides detailed answers to frequently asked questions regarding the Child Allowance 2023 program, addressing eligibility criteria, benefits, and application procedures.

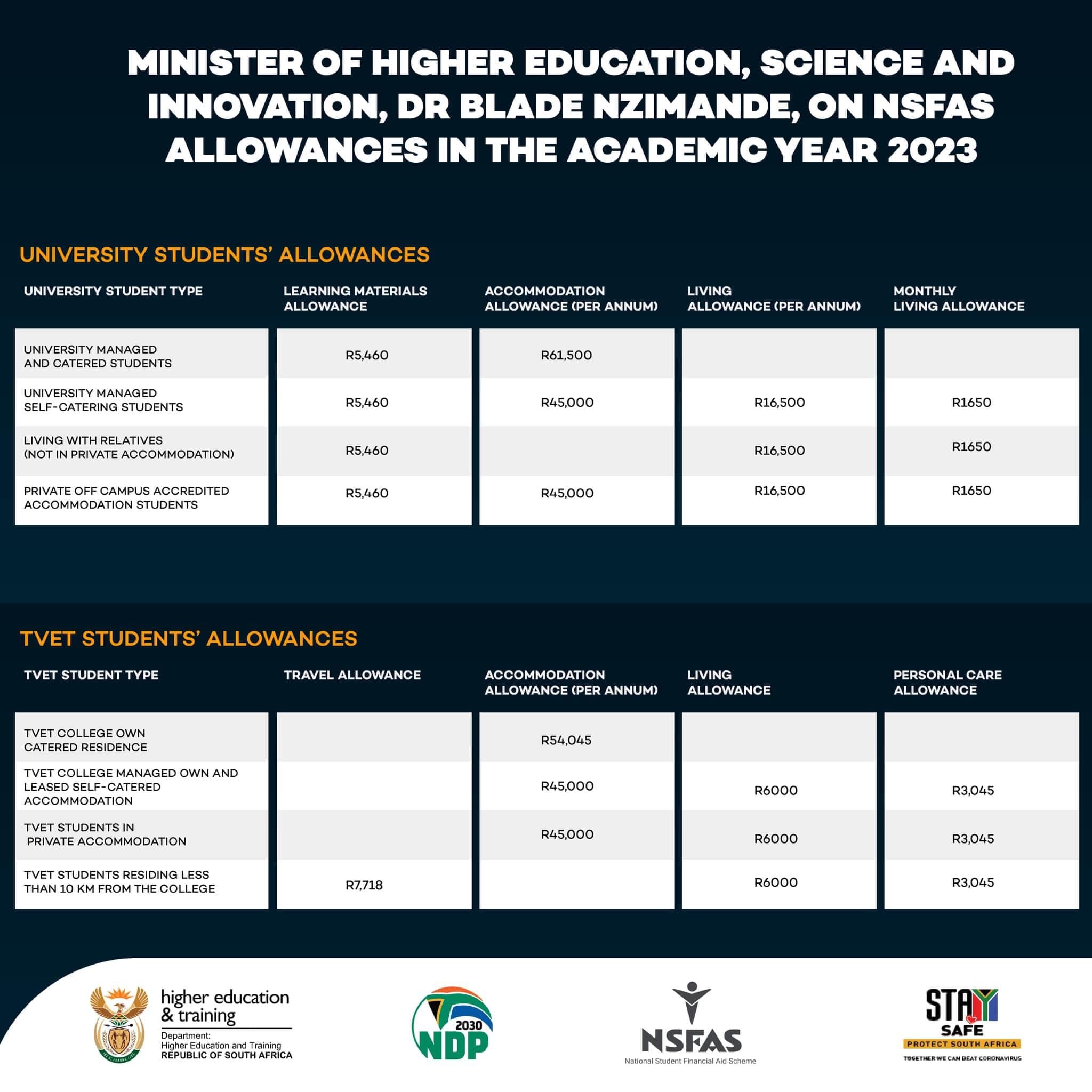

NSFAS New Pass Criteria & Allowance Amounts for 2023 - Source www.sassagrants.co.za

Question 1: Who is eligible to receive the Child Allowance 2023?

The Child Allowance is available to eligible individuals who meet specific income and residency requirements. To qualify, individuals must have a valid Social Security number, meet certain income limits, and be a U.S. citizen or resident alien.

Question 2: What are the age requirements for children to qualify for the Child Allowance 2023?

Eligible children must be under the age of 18 or a full-time student under the age of 24 at the end of the tax year.

Question 3: How much is the Child Allowance amount for 2023?

The Child Allowance for 2023 is $$2,000 for each qualifying child, with an additional $$500 for children under age 6.

Question 4: How is the Child Allowance 2023 paid out?

The Child Allowance is typically distributed through monthly payments in advance or as a lump sum tax refund after filing a tax return.

Question 5: What is the deadline to apply for the Child Allowance 2023?

To receive payments for the full year, individuals must file their 2023 tax return by the tax filing deadline, which is typically April 15th of the following year.

Question 6: What are the potential tax implications of claiming the Child Allowance 2023?

Claiming the Child Allowance may affect certain tax credits and deductions. Individuals should consult with a tax professional to determine the specific impact on their situation.

These FAQs provide a comprehensive overview of the Child Allowance 2023 program. By understanding these details, individuals can determine their eligibility, maximize the benefits, and fulfill the application requirements to receive this financial assistance.

For comprehensive information, please refer to the official government website or consult with a qualified tax advisor.

Tips

Obtaining the Child Allowance in 2023 requires careful preparation and adherence to specific guidelines. This comprehensive guide provides essential tips to assist individuals and families in maximizing their eligibility and accessing this valuable benefit. Child Allowance 2023: Comprehensive Guide For Eligibility, Benefits, And Application By following these practical recommendations, applicants can streamline the process, enhance their chances of approval, and secure the full extent of financial support available.

Tip 1: Determine Eligibility Criteria

Understanding the eligibility requirements is crucial. Review the income thresholds, age limits, and residency conditions thoroughly to ascertain whether you qualify for the allowance. Gather necessary documentation, such as proof of income, child's birth certificate, and proof of residency, to support your application.

Tip 2: File on Time

Adhere to the application deadlines to avoid delays or potential ineligibility. Submitting your application promptly ensures timely processing and eliminates the risk of missing out on benefits.

Tip 3: Gather Required Documents

Organize and prepare all necessary documents before initiating the application process. Ensure that the documentation is complete, accurate, and up-to-date to expedite the review and approval process.

Tip 4: Utilize Available Resources

Seek assistance from reliable sources, such as government agencies, financial institutions, or non-profit organizations. These entities often provide guidance, support, and resources to help individuals navigate the application process effectively.

Tip 5: Keep Records

Maintain a record of your application, including copies of submitted documents and communication with relevant authorities. This documentation serves as a valuable reference and aids in resolving any discrepancies or issues that may arise during the process.

Summary

By implementing these practical tips, individuals and families can increase their likelihood of securing the Child Allowance in 2023. Understanding eligibility criteria, filing promptly, gathering required documentation, utilizing available resources, and keeping records are essential steps to maximize the benefits of this valuable support program.

Child Allowance 2023: Comprehensive Guide For Eligibility, Benefits, And Application

Understanding the essential aspects of the Child Allowance for 2023 is fundamental for families looking to optimize benefits.

Meal Allowance 2023 Benefits - Image to u - Source imagetou.com

- Eligibility: Conditions for qualifying for the allowance.

- Benefits: Financial and non-financial advantages provided by the allowance.

- Application: Process and documentation required to apply for the allowance.

- Age: Limits and considerations for children's age in relation to the allowance.

- Income: Thresholds and restrictions based on family income levels.

- Taxation: Implications and considerations for taxation related to the allowance.

The interrelation of these aspects influences the overall effectiveness of the Child Allowance for families. For instance, eligibility conditions and income thresholds determine the accessibility of the allowance, while benefits and taxation implications shape its financial impact. By understanding these key aspects, families can navigate the application process effectively and maximize the value of the Child Allowance 2023.

Machine Learning Frameworks Mastery: Your 2023 Comprehensive Guide - Source octavius.ai

Child Allowance 2023: Comprehensive Guide For Eligibility, Benefits, And Application

The Child Allowance is a tax credit that helps families offset the cost of raising children. The credit is available to taxpayers who meet certain eligibility requirements. In this comprehensive guide, we will explore the eligibility requirements, benefits, and application process for the Child Allowance in 2023.

LTA: Know Leave Travel Allowance Tax Benefits, Eligibility - Source www.smcinsurance.com

The Child Allowance is a refundable tax credit, which means that it can reduce your tax liability to zero. The amount of the credit is based on the number of qualifying children you have. For 2023, the maximum credit is $2,000 per qualifying child.

To be eligible for the Child Allowance, you must meet the following requirements:

- You must be the parent or legal guardian of the child.

- The child must be under the age of 17 at the end of the tax year.

- The child must be a U.S. citizen or resident alien.

- The child must live with you for more than half of the tax year.

- You must provide more than half of the child's support for the tax year.

If you meet the eligibility requirements, you can claim the Child Allowance on your tax return. The credit is claimed on the Form 1040. You will need to provide the child's name, Social Security number, and relationship to you.

The Child Allowance is a valuable tax credit that can help you save money on your taxes. If you have qualifying children, you should make sure to claim the credit on your tax return.

Conclusion

The Child Allowance is an important tax credit that can help families with the cost of raising children. The credit is available to taxpayers who meet certain eligibility requirements. By understanding the eligibility requirements, benefits, and application process, you can make sure that you are claiming the full amount of the credit that you are entitled to.

If you have any questions about the Child Allowance, you should consult with a tax professional.