NEW INFO | Discussing the latest information from various media and various fields

Bitcoin Market Analysis And Predictions: Latest News, Insights, And Market Trends

The cryptocurrency market is constantly evolving, and Bitcoin is no exception. In order to make informed decisions about investing in Bitcoin, it is important to stay up-to-date on the latest news, insights, and market trends.

Editor's Notes: Bitcoin Market Analysis And Predictions: Latest News, Insights, And Market Trends have published today date. This topic is important to read because it provides valuable information that can help investors make informed decisions about investing in Bitcoin.

Our team has done some analysis, digging information, made Bitcoin Market Analysis And Predictions: Latest News, Insights, And Market Trends we put together this Bitcoin Market Analysis And Predictions: Latest News, Insights, And Market Trends guide to help target audience make the right decision.

Here are some of the key differences or Key takeways, provide in informative table format

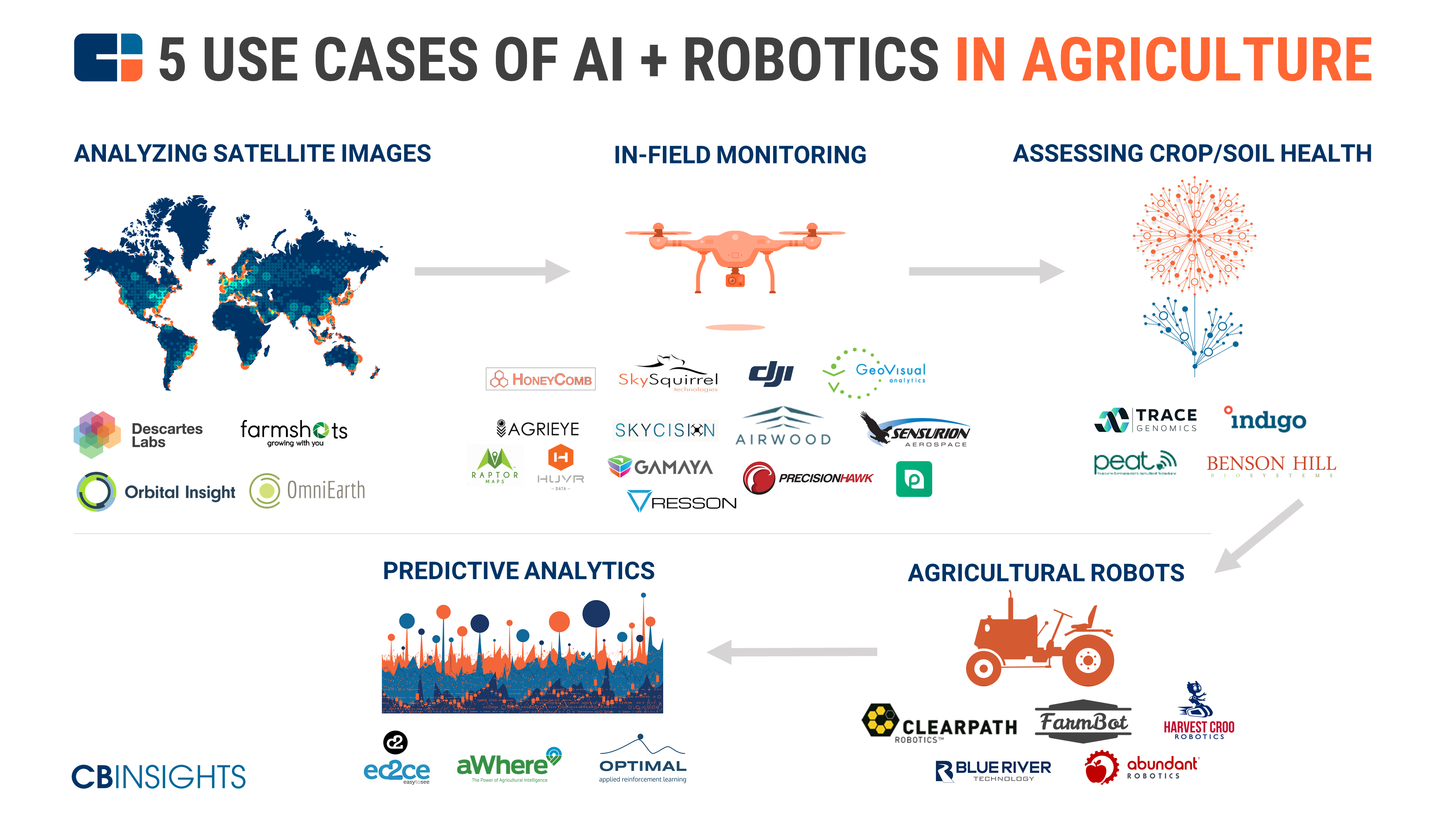

GeoVisual featured in CB InSights market map of companies bringing AI - Source www.geovisual-analytics.com

Transition to main article topics

FAQ

Bitcoin Market Analysis And Predictions: Latest News, Insights, And Market Trends

What is the current market value of bitcoin | Asta Coin - Source astacoin.pages.dev

Question 1: What factors influence bitcoin's price?

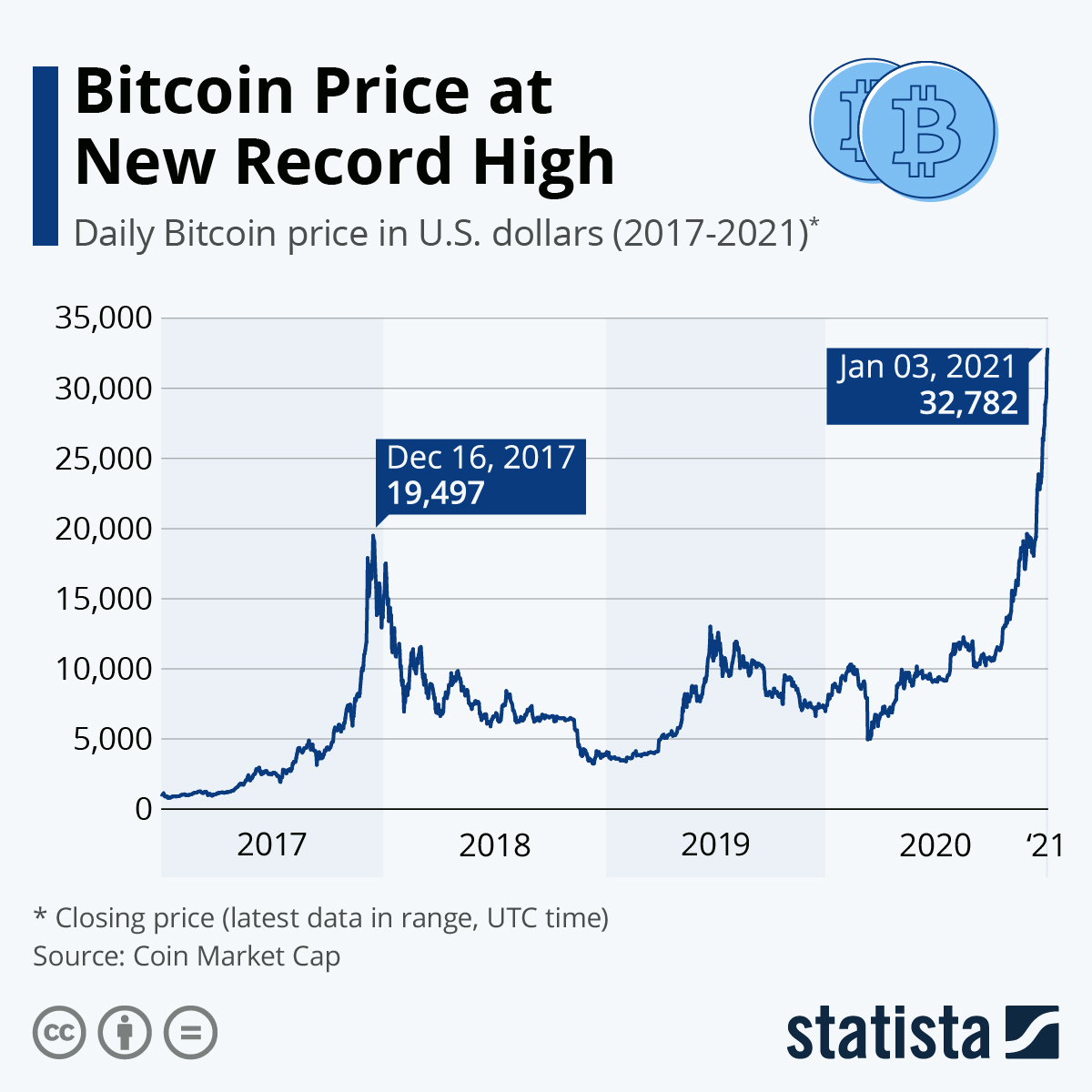

Bitcoin's price is determined by a complex interplay of various factors, including supply and demand dynamics, technological developments within the blockchain ecosystem, regulatory and legal frameworks, global economic conditions, news events, and speculative trading activity.

Question 2: How can I buy bitcoin?

There are several ways to buy bitcoin, including through cryptocurrency exchanges, peer-to-peer marketplaces, and automated teller machines (ATMs).

Question 3: Is bitcoin a safe investment?

Bitcoin's volatility and susceptibility to market fluctuations make it a risky investment compared to traditional assets like stocks or bonds.

Question 4: What is the future of bitcoin?

The long-term trajectory of bitcoin's price and adoption remains uncertain, but it has demonstrated resilience and continued to attract interest from investors and enthusiasts.

Question 5: How do I store my bitcoin?

Bitcoin can be stored in a variety of ways, including in software or hardware wallets, exchange accounts, or paper wallets.

Question 6: What are the tax implications of bitcoin transactions?

Tax regulations for bitcoin transactions vary by jurisdiction, and it's essential to understand the laws applicable in your region.

By addressing these common questions, we hope to provide a better understanding of bitcoin and its implications for investors and the broader financial landscape. For more comprehensive insights and up-to-date analysis, refer to the comprehensive content provided in "Bitcoin Market Analysis And Predictions: Latest News, Insights, And Market Trends."

Stay informed and make informed decisions as the cryptocurrency market continues to evolve.

Tips

Green light for sustainable hedging - Source www.rbinternational.com

Stay on top of the latest Bitcoin Market Analysis And Predictions: Latest News, Insights, And Market Trends for informed decision-making.

Tip 1: Analyze Market Trends

Study historical price data, market sentiment, and volume to identify patterns, support and resistance levels, and potential trading opportunities.

Tip 2: Understand Technical Indicators

Utilize technical indicators such as moving averages, Bollinger Bands, and RSI to gauge market momentum, overbought or oversold conditions, and potential trend reversals.

Tip 3: Monitor News and Events

Stay up-to-date on industry news, regulatory changes, and upcoming events that can impact Bitcoin's price.

Tip 4: Diversify Portfolio

Avoid concentrating all investments in Bitcoin. Diversify into other cryptocurrencies, assets, and investment strategies to mitigate risk.

Tip 5: Use Risk Management Tools

Implement stop-loss orders, position sizing, and risk-reward ratios to limit potential losses and protect capital.

To enhance your knowledge further, we recommend visiting the Bitcoin Market Analysis And Predictions: Latest News, Insights, And Market Trends page for comprehensive analysis, forecasts, and market insights.

Bitcoin Market Analysis And Predictions: Latest News, Insights, And Market Trends

In the dynamic realm of Bitcoin, understanding the intricacies of market analysis and predictions holds immense significance. Informed decisions and strategic investments hinge upon a comprehensive grasp of key aspects that drive market movements, empower investors to navigate volatility, and seize opportunities. These pivotal elements include:

- Technical Indicators: Utilizing charts and patterns to decipher market sentiment

- Economic Factors: Monetary policies, inflation, and geopolitical events influencing market trends

- Adoption Rate: Growth in Bitcoin usage as a medium of exchange and store of value

- Regulatory Landscape: Evolving regulations and their impact on market stability

- Sentiment Analysis: Gauging investor sentiment through social media, news articles, and market data

- Technological Advancements: Innovations in blockchain technology and infrastructure shaping market dynamics

Market Insights: April 2024 | M&M Real Estate - Source www.mandmrealestate.ae

These aspects are interconnected and exert a profound influence on the Bitcoin market. By monitoring technical indicators, investors can identify potential trading opportunities and manage risk. Economic factors play a crucial role in shaping long-term market trends, while adoption rate indicates the growing acceptance of Bitcoin. Regulatory developments can instill confidence or uncertainty, impacting market volatility. Sentiment analysis provides insights into investor psychology, while technological advancements drive innovation and expand the utility of Bitcoin. Understanding and integrating these key aspects into market analysis and predictions empowers investors to make informed decisions, adapt to changing market conditions, and capitalize on emerging trends.

Bitcoin Market Analysis And Predictions: Latest News, Insights, And Market Trends

Market analysis and predictions are essential components of successful Bitcoin trading. By understanding the latest news, market trends, and expert insights, traders can make informed decisions about their investments. Market analysis helps traders identify potential trading opportunities, while predictions provide insights into future price movements. By leveraging these tools, traders can increase their chances of profitability and minimize their risks.

Advocacy Archives - Cigar Association of America - Source cigarsusa.org

Bitcoin market analysis and predictions rely on a combination of technical and fundamental analysis. Technical analysis involves studying historical price data to identify patterns and trends. Fundamental analysis, on the other hand, focuses on factors such as economic conditions, news events, and market sentiment. By combining these two approaches, traders can gain a comprehensive understanding of the market and make more informed trading decisions.

Market analysis and predictions are essential tools for successful Bitcoin trading. By understanding the factors that drive price movements, traders can make better investment decisions and increase their chances of profitability.

Conclusion

Market analysis and predictions are essential components of successful Bitcoin trading. By understanding the latest news, market trends, and expert insights, traders can make informed decisions about their investments. Market analysis helps traders identify potential trading opportunities, while predictions provide insights into future price movements. By leveraging these tools, traders can increase their chances of profitability and minimize their risks.

The Bitcoin market is constantly evolving, so it is important for traders to stay up-to-date on the latest news and analysis. By doing so, traders can make more informed decisions and improve their chances of success.